Most companies report measurable benefits from AI where it has been deployed; however, much work remains to scale impact, manage risks, and retrain the workforce. A group of high performers shows the way.

Adoption of artificial intelligence (AI) continues to increase, and the technology is generating returns. The findings of the latest McKinsey Global Survey on the subject show a nearly 25 percent year-over-year increase in the use of AI in standard business processes, with a sizable jump from the past year in companies using AI across multiple areas of their business. A majority of executives whose companies have adopted AI report that it has provided an uptick in revenue in the business areas where it is used, and 44 percent say AI has reduced costs.

The results also show that a small share of companies—from a variety of sectors—are attaining outsize business results from AI, potentially widening the gap between AI power users and adoption laggards. Respondents from these high-performing companies (or AI high performers) report that they achieve greater scale and see both higher revenue increases and greater cost decreases than other companies that use AI. The findings, however, provide a potential road map for laggards, showing that the AI high performers are more likely to apply core practices for using AI to drive value across the organization, mitigate risks associated with the technology, and retrain workers to prepare them for AI adoption.

Further, our results suggest that workforce retraining will need to ramp up. While the findings indicate that AI adoption has generally had modest overall effects on organizations’ workforce size in the past year, about one-third of respondents say they expect AI adoption to lead to a decrease in their workforce in the next three years, compared with one-fifth who expect an increase, and AI high performers are doing more retraining.

Most respondents are seeing returns from AI

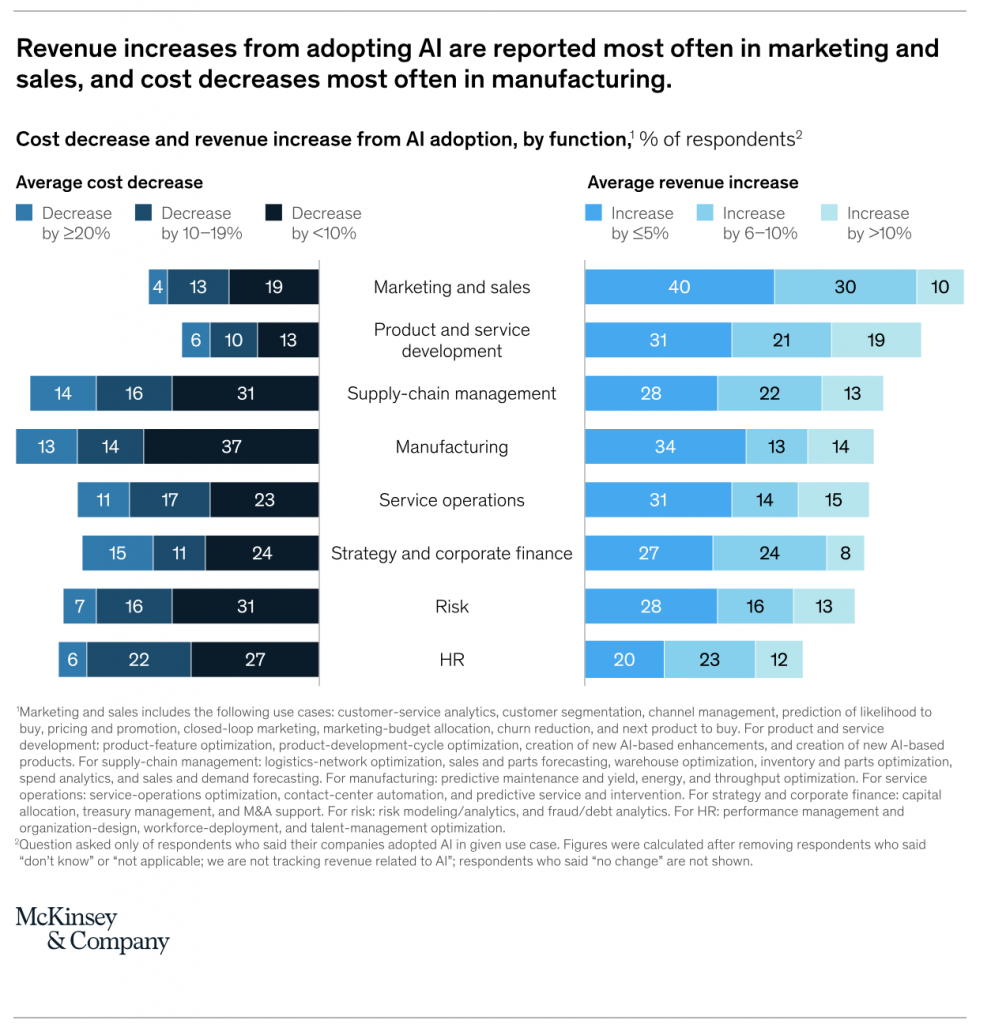

In this year’s survey, we asked respondents about 33 AI use cases across eight business functions, including how adoption of AI for each of these activities has affected revenue and cost in the business units where AI is used. The results suggest that AI is delivering meaningful value to companies.

Aggregating across all of the use cases, 63 percent of respondents report revenue increases from AI adoption in the business units where their companies use AI, with respondents from high performers nearly three times likelier than those from other companies to report revenue gains of more than 10 percent. Respondents are most likely to report revenue growth from AI use cases in marketing and sales, product and service development, and supply-chain management (Exhibit 1). In marketing and sales, respondents most often report revenue increases from AI use in pricing, prediction of likelihood to buy, and customer-service analytics. In product and service development, revenue-producing use cases include the creation of new AI-based products and new AI-based enhancements. And in supply-chain management, respondents often cite sales and demand forecasting and spend analytics as use cases that generate revenue.

Overall, 44 percent of respondents report cost savings from AI adoption in the business units where it’s deployed, with respondents from high performers more than four times likelier than others to say AI adoption has decreased business units’ costs by at least 10 percent, on average. The two functions in which the largest shares of respondents report cost decreases in individual AI use cases are manufacturing and supply-chain management. In manufacturing, responses suggest some of the most significant savings come from optimizing yield, energy, and throughput. In supply-chain management, respondents are most likely to report savings from spend analytics and logistics-network optimization.

AI adoption is increasing in nearly all industries, but capabilities vary

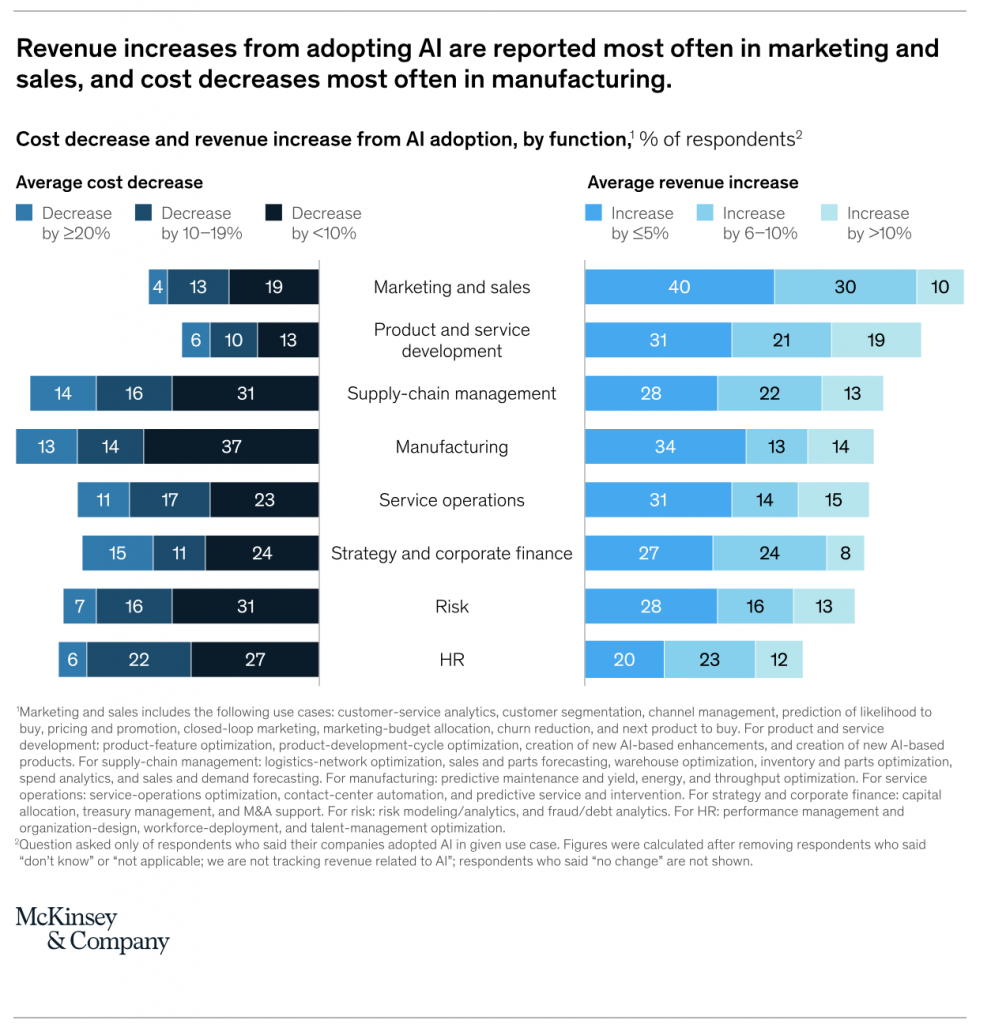

As in last year’s survey, we asked respondents about their companies’ use of nine AI capabilities. Fifty-eight percent of respondents report that their organizations have embedded at least one AI capability into a process or product in at least one function or business unit, up from 47 percent in 2018—a sign that AI adoption in general is becoming more mainstream. What’s more, responses show an increase in the share of companies using AI in products or processes across multiple business units and functions: 30 percent of this year’s respondents report doing so, compared with 21 percent in the previous survey. While this seems to indicate that more companies are beginning to scale AI, high performers are much further along in these efforts, averaging 11 reported AI use cases across the organization versus about three among other companies.

By sector, the results indicate increases in AI adoption in nearly every industry in the past year. Retail has seen the largest increase, with 60 percent of respondents saying their companies have embedded at least one AI capability in one or more functions or business units, a 35-percentage-point increase from 2018.

The results show companies applying AI capabilities that help them perform the functions that create value in their industries. For example, respondents from consumer-packaged-goods companies are more likely to report using physical robotics—which can aid in assembly tasks—than most other types of capabilities. And telecom respondents report their companies using virtual agents—which can be used in customer-service applications—more than other capabilities (Exhibit 2). High-performing companies, however, are far more likely to adopt AI in business functions that this survey and past research link to greater value creation more broadly. For example, more than 80 percent of respondents from high performers say they have adopted AI in marketing and sales, compared with only one-quarter from those of other companies that use AI.

On a regional level, the survey shows significant increases in adoption levels in developed Asia–Pacific, Europe, Latin America, and North America. In Asia–Pacific and Latin America, the shares of respondents who say their companies have embedded AI across multiple functions or business units have nearly doubled since the previous survey. However, the increases put all of these regions, as well as China, at similar aggregate reported levels of adoption, suggesting that while there is considerable variation at the level of individual companies, the adoption of AI is a global phenomenon.

The results indicate that the pace of adoption will likely continue in the near term, with 74 percent of respondents whose companies have adopted or plan to adopt AI saying their organizations will increase their AI investment in the next three years. More than half of these respondents expect an increase of 10 percent or more. But the survey results indicate that AI high performers plan to invest more, with nearly 30 percent of respondents from these companies saying their organizations will increase investment in AI by 50 percent or more in the next three years, compared with just 9 percent of others who say the same.

AI high performers tend to engage in value-capturing practices

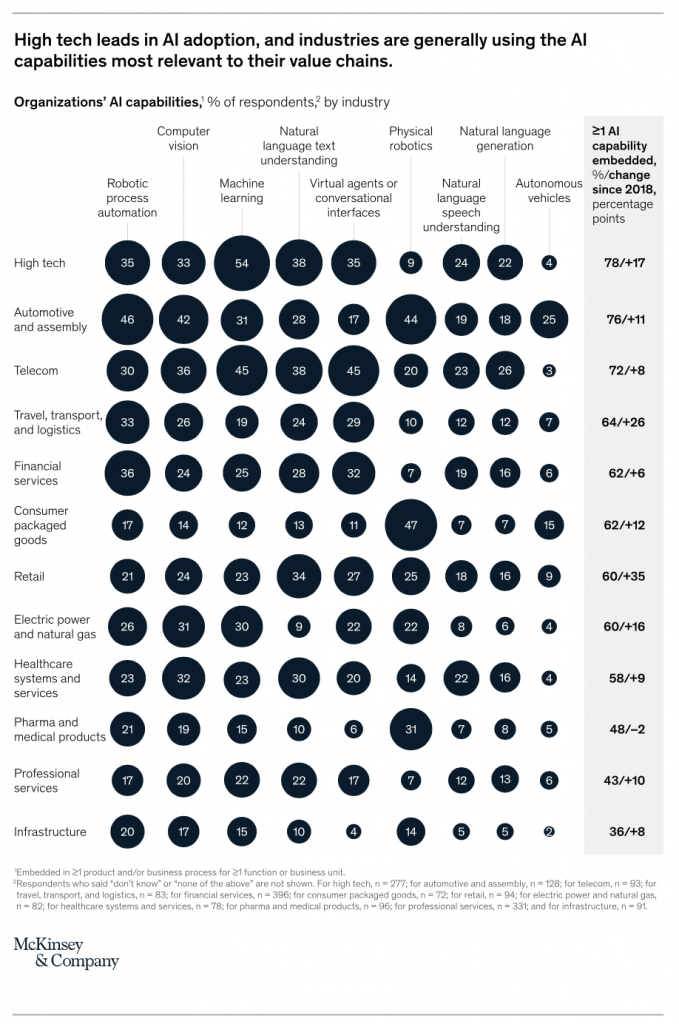

According to our experience and past research on analytics, some core practices are necessary to capture value at scale. These include, among others, aligning business, analytics, and IT leaders on the potential value at stake from AI across each business domain; investing in talent, such as translator expertise; and ensuring that business staff and technical teams have the skills necessary for successful scaling.

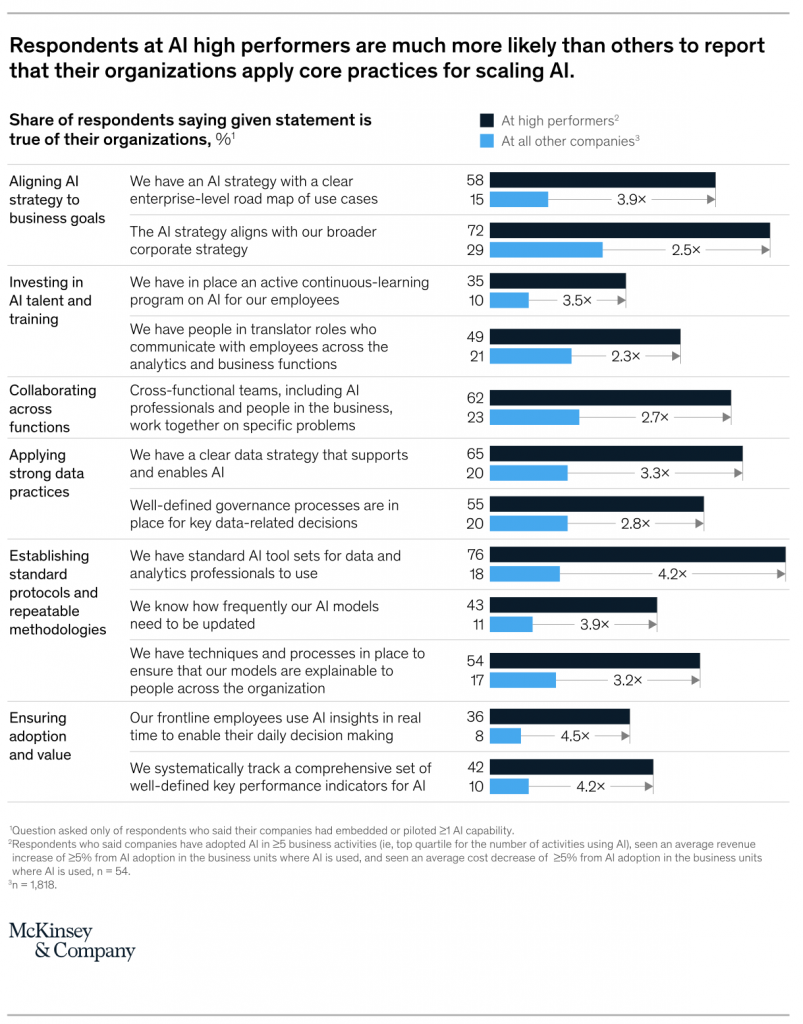

The survey results suggest these core practices hold true for scaling AI, given that respondents at AI high performers are far more likely than others to say their organizations apply these practices (Exhibit 3). For example, 72 percent of respondents from AI high performers say their companies’ AI strategy aligns with their corporate strategy, compared with 29 percent of respondents from other companies. Similarly, 65 percent from the high performers report having a clear data strategy that supports and enables AI, compared with 20 percent from other companies.

Even the AI high performers have work to do in several key areas. For example, only 36 percent of respondents from these companies say their frontline employees use AI insights in real time for daily decision making, and just 42 percent systematically track a comprehensive set of well-defined key performance indicators for AI—two practices, in our experience, that are crucial for achieving end-user adoption and value. Likewise, only 35 percent of respondents from AI high performers report having an active continuous-learning program on AI for employees.

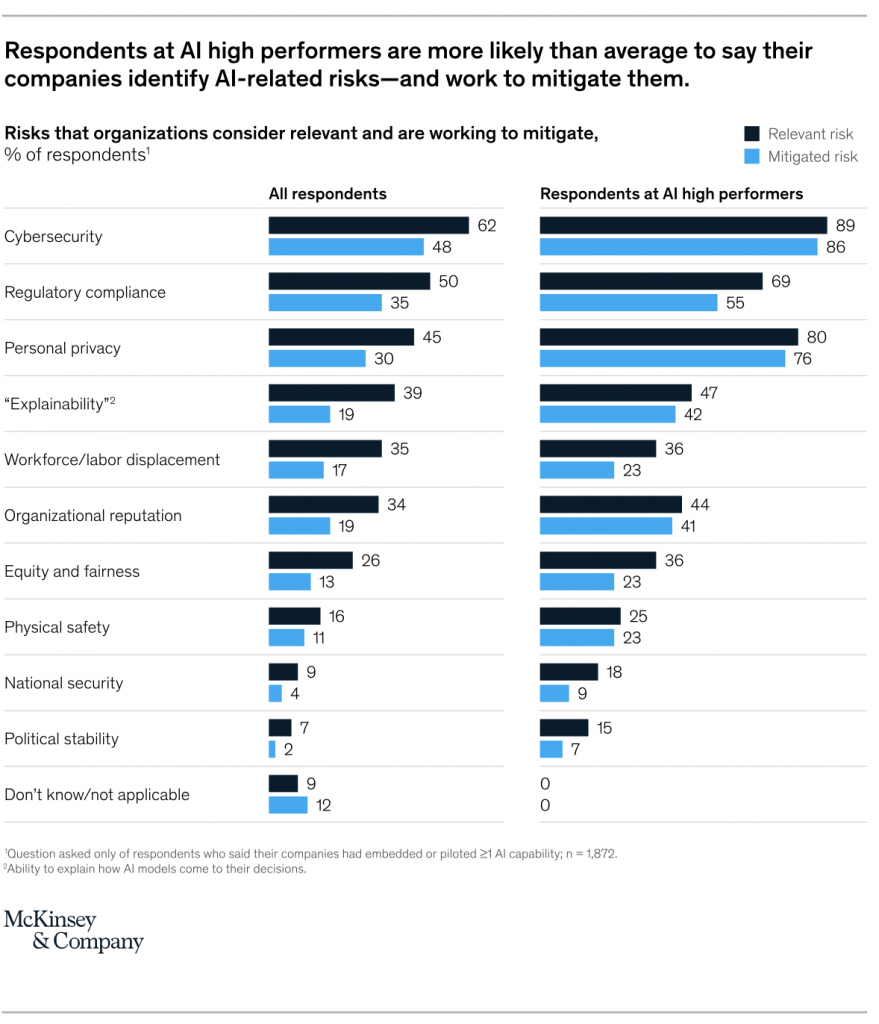

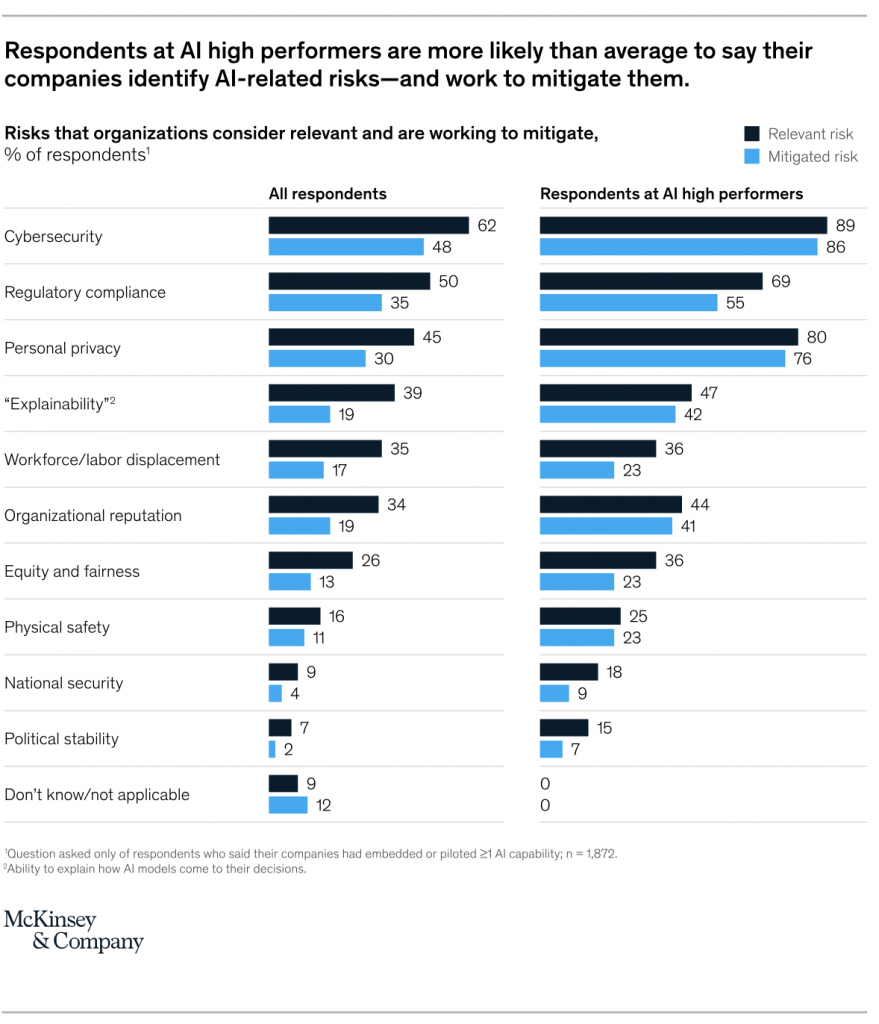

A minority of companies acknowledge most AI risks—fewer mitigate them

Despite extensive dialogue across industries about the potential risks of AI and highly publicized incidents of privacy violations, unintended bias, and other negative outcomes, the survey findings suggest that a minority of companies recognize many of the risks of AI use. Even fewer are taking action to protect against the risks.

Fewer than half of respondents (41 percent) say their organizations comprehensively identify and prioritize their AI risks. The survey also asked specifically about ten of the most widely recognized risks. Of them, respondents most often cite cybersecurity and regulatory compliance as the AI-related risks their companies consider relevant (Exhibit 4). These two risks are the only ones that at least half of respondents cite as relevant. Furthermore, the share of respondents saying their companies are mitigating each risk is smaller than the share citing it as relevant. For example, while 39 percent of respondents say their companies recognize risk associated with “explainability” (the ability to explain how AI models come to their decisions), only 21 percent say they are actively addressing this risk. At the companies that reportedly do mitigate AI risks, the most frequently reported tactic is conducting internal reviews of AI models.

Respondents at AI high performers are likelier than those from other companies to say their organizations both recognize and work to reduce risks. Take personal-privacy risk, which is squarely in regulators’ line of sight. Eighty percent of respondents at high-performing companies say their companies consider personal-privacy risk to be relevant, compared with less than half of respondents from other companies. When asked about internal controls aimed at reducing privacy risks, 89 percent of respondents at high-performing companies say their organizations adopt and enforce enterprise-wide privacy policies, compared with 68 percent of other respondents. Similarly, 80 percent of respondents at AI high performers report that their organizations implement tech-enabled access restrictions to sensitive data, versus 59 percent of those at other companies.

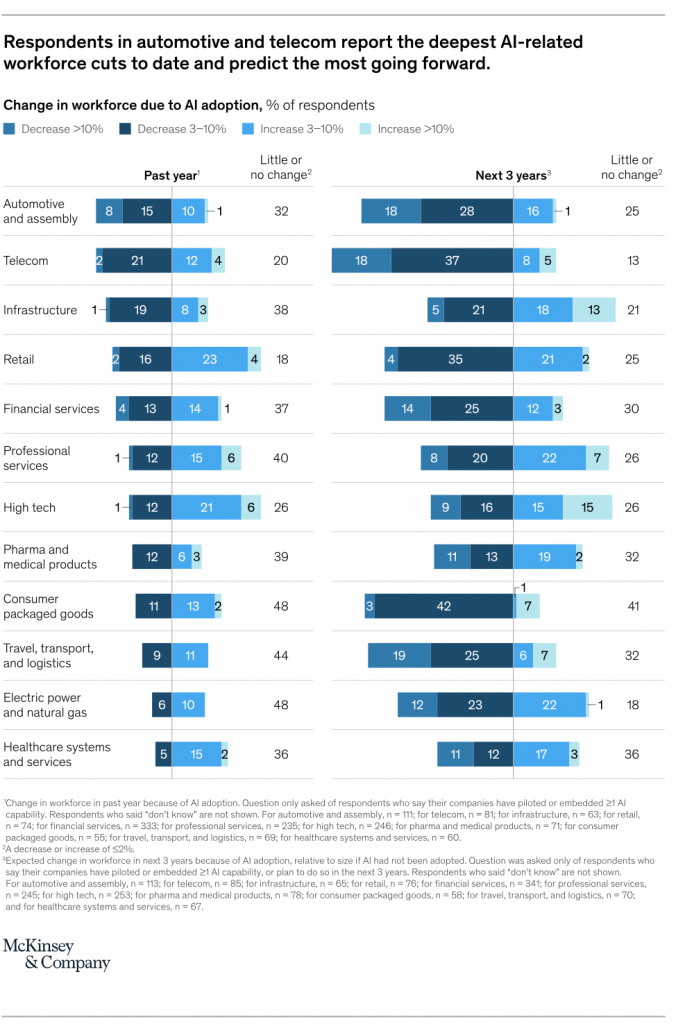

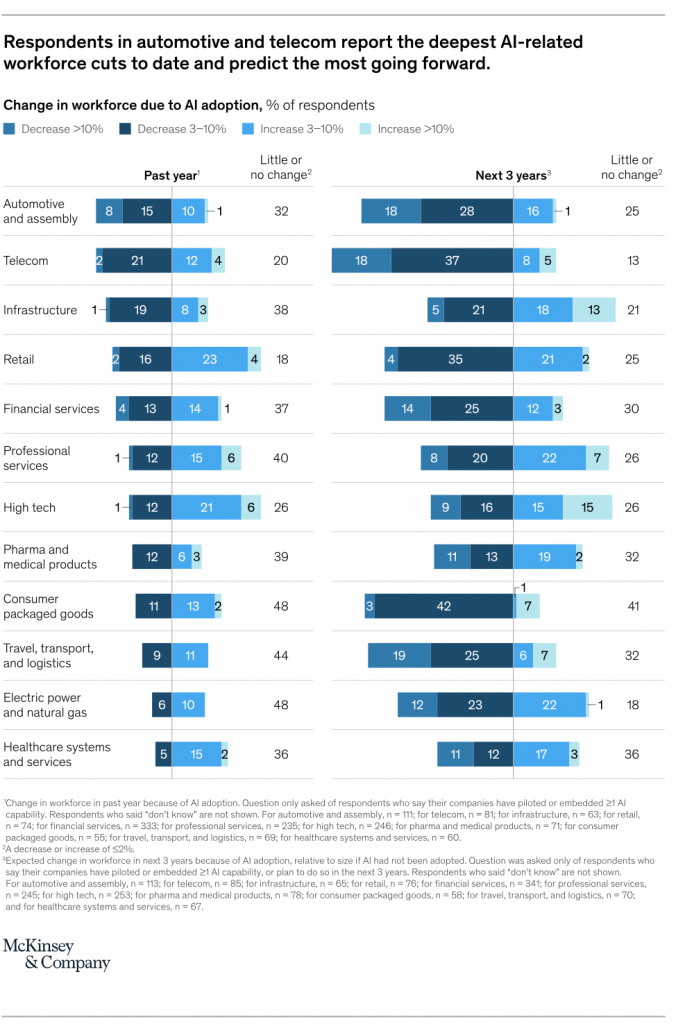

More expect AI to cause workforce decreases than increases, with variances across functions

Generally, there has been increasing concern that AI will lead to workforce reduction. The survey findings suggest that, thus far, this concern has largely not been realized. More than one-third of respondents report less than a 3 percent change in their companies’ workforce size because of AI deployment, and only 5 percent of respondents report a change, whether decrease or increase, of greater than 10 percent. While respondents from a handful of industries, including automotive and assembly, are more likely to report a workforce reduction than an increase in the past year because of AI (Exhibit 5), more respondents overall report job increases of 3 percent or more at their companies in the past year than report decreases of the same magnitude (17 percent and 13 percent, respectively).

But the outlook for the next three years could be shifting. Thirty-four percent of respondents from organizations that have adopted or plan to adopt AI expect it to drive a decrease in the number of employees, versus 21 percent who expect an increase—although most predict the change to be less than 10 percent in either direction. Another 28 percent foresee AI adoption having little impact on workforce size, with any expected change being less than 3 percent.

Respondents also expect AI adoption to cause shifts in their workforce across functions. Respondents are more likely to predict a decrease than an increase in employment levels in HR, manufacturing, supply-chain management, and service operations. They more often predict an increase than a decrease in the number of employees in product development and marketing and sales.

Greater emphasis on workforce retraining is likely

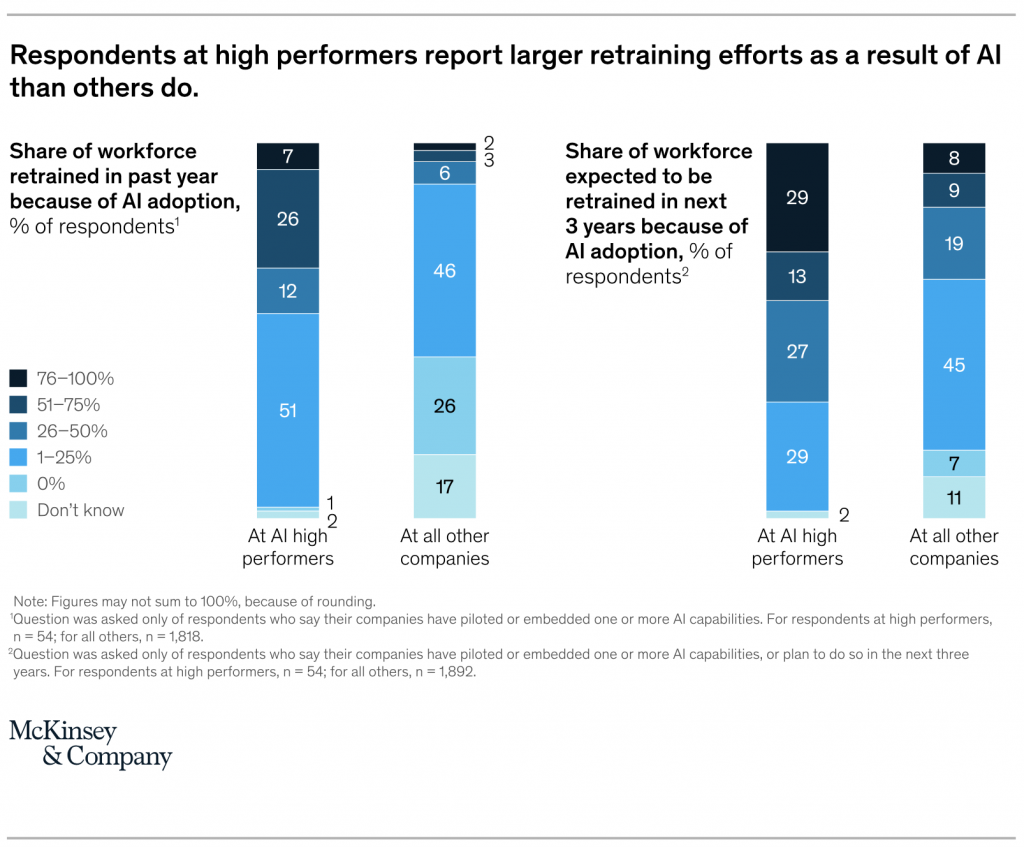

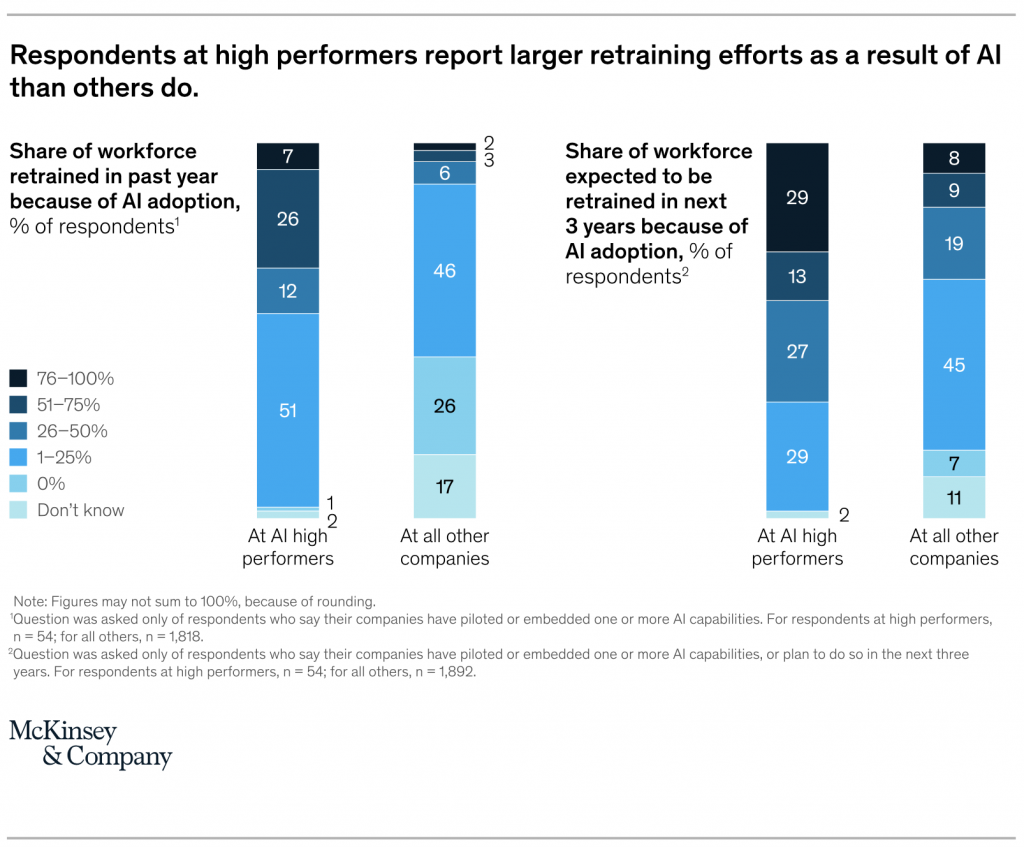

The results indicate that a majority of respondents’ companies are preparing for AI-related workforce changes. When asked about retraining workers in response to AI adoption, nearly six in ten respondents at companies using AI say at least some of their workforce has been retrained in the past year. In addition, 83 percent of respondents expect at least some of their workforce to be retrained in the next three years because of AI adoption, and 38 percent expect more than a quarter to be retrained.

Respondents at AI high performers report retraining much greater shares of employees in the past year because of AI, compared with respondents at other companies that have adopted AI (Exhibit 6). Respondents at high performers also predict that their companies will retrain larger shares of their workforce in the next three years.

With the research showing that companies now use AI more often than not, the technology appears to have reached another stepping stone in its ascent in business. Along with it comes a ratcheting up of the urgency to scale AI among those still early in their adoption journeys. However, while the survey results indicate that some companies are further ahead in realizing AI’s impact, they also suggest a path for lagging companies to catch up.

English

English