There’s a well-known quote attributed to Henry Ford that he actually never said but that historians confirm he almost certainly believed: “If I had asked people what they wanted, they would have said faster horses.”1 The story resonates, of course, because we know what consumers circa 1900 thought mobility was supposed to mean, and we know from about 1920 onward what mobility in fact came to mean.

And still does. Indeed, the extent to which Ford’s (and his contemporaries’) automobile paradigm has endured is remarkable. One hundred years ago, mobility conjured cars and trucks, a space to park and the price at the pump, city streets and open roads. And more: “the freedom machine,” mass transportation, car dealerships, internal combustion. Congestion. Accidents. Pollution.

At the first great inflection point, the fundamental dimensions of transportation—cost, convenience, user experience, safety, and environment—saw “mobility” and “cars” become well-nigh synonymous. That was a dramatic shift from the previous several hundred years, when overland mobility meant horses, which people needed in ever-growing numbers. Emissions problems of a different sort than today’s were an unintended consequence. In 1894, the London Times ran the numbers: at prevailing rates, nine feet of manure would accumulate on city streets by the mid-1940s.2

A forecast in 1894 envisioned nine feet of manure on the streets of London by the mid-1940s.

The amazing developments of 1900–20 represented mobility’s first inflection point. They took us from steam to internal-combustion engines (ICEs), the “Great Horse Manure Crisis” of 1894 to “Big Oil,” and premium automobiles for the few to mass-produced cars for the millions. They also altered and even birthed entire businesses, industries, and government entities that developed alongside, but distinct from, the automotive industry: repair shops, highway authorities, gas stations, commuter railways, and car washes, to name just a few. The landscape has endured for decades.

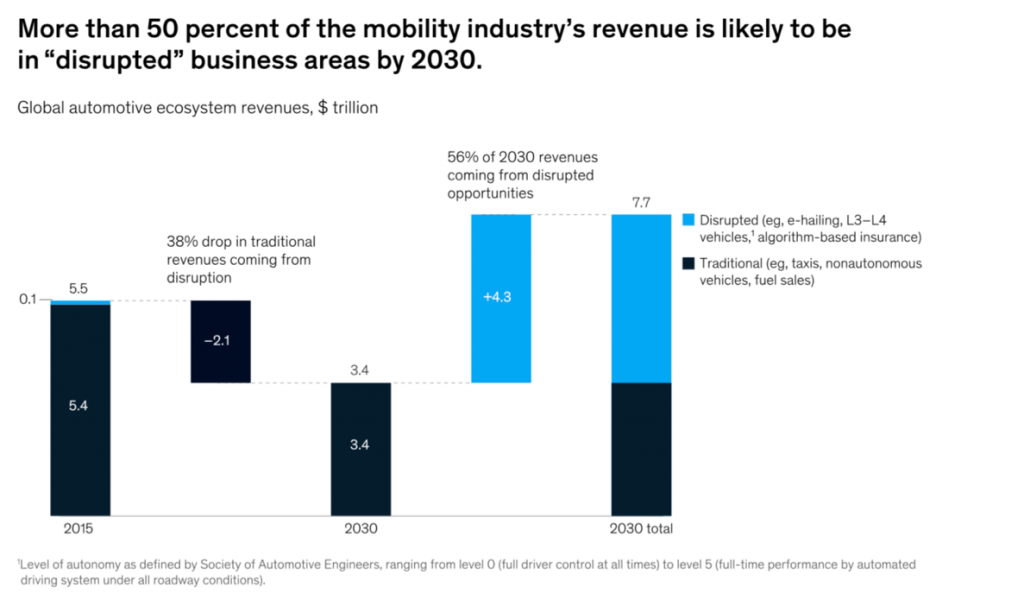

But for how much longer? By 2030, we’ll see developments that may be as profound as those of a hundred years before. Radical changes—“horses-to-cars” changes, “how-we-think-about-mobility” changes—are coming, even faster this time, and across multiple dimensions. The characteristics of mobility at the second great inflection point will be significantly, not just marginally, better. Electric and autonomous vehicles, more interconnected and intelligent road networks, new customer interfaces and services, and a dramatically different competitive landscape in which tech giants, start-ups, and OEMs mix and mingle are just a few of the shifts in store. Radical improvements in cost-effectiveness, convenience, experience, safety, and environmental impact will, taken together, disrupt myriad business models on an almost inconceivable scale (exhibit).

With any luck, it will be what people actually want—not “faster horses,” but something qualitatively different and better. We call these coming changes mobility’s Second Great Inflection Point. In this article, we’ll explain why we think it’s coming, starting with a look back at the inflection point that took place 100 years ago, including its unintended consequences, and the forces at work pushing toward a new paradigm. A second, companion article lays out the likely characteristics of the emerging mobility ecosystem, along with the impact it is likely to have on business and society.

As with many great changes, the picture is compelling both at a distance and in close-up. More than two dozen of our McKinsey colleagues, plus some of the executives leading the charge toward the future, provide the latter—snapshots of the technology shifts that leaders should have on their radar screen, the variations on this story in different geographies, and the ways in which cities as we know them are likely to change. Neither we nor anyone else knows exactly how or when these shifts will play out. What’s become increasingly clear, though, is that the change is coming much faster than most of us thought possible just a few years ago.

Part 1

The first great inflection point

When discussing automobiles and timelines, it’s worth remembering that it took a long time for the car to become mainstream. The first steam-powered vehicle was crafted in the late 17th century, though it was too small to carry people or cargo. It took 200 years for contraptions with internal-combustion engines to be on the open roads. By the dawn of the 20th century, vehicles were progressing from open “buggies without horses” to more sophisticated “road locomotives”—self-powered cars.

Until the dawn of the 20th century, however, these vehicles had been tailored primarily for the privileged “class” market. What made the Model T so transformative when it rolled out in October 1908 was not that it introduced the assembly line (it didn’t) or that it was an inconceivable leap in technology (it wasn’t). Instead, the Model T’s combination of reliability, innovation, and, especially, affordability could at last bring personalized, mechanized mobility to the masses. Henry Ford famously made sure to pay his employees $5 per day; they, too, would be able to afford them. His car was priced around $500, less than $10,000 in today’s dollars.

It was only when the automobile became affordable that it truly became the freedom machine.

The freedom machine was born, and giving the people what they wanted (lower transportation costs, more convenience, a better driving experience), even with the trade-offs (particularly in terms of safety and the environment), sparked one of the greatest success stories in business history. In 1900, about 4,000 automobiles were produced in the United States; none of them were trucks. During the 1910s, the number of automobiles across different parts of the United States began to eclipse the number of horses and buggies. By 1920, America had more than 9.2 million registered motor vehicles, including more than one million trucks.

But simply counting cars and trucks fails to capture the magnitude of the First Great Inflection Point and the immensity of its second-order effects. On the left side of the growth curve were steam and hay (and feet), dirt roads, manure-filled cities, and sleepy countryside. Past the inflection came gasoline, paved roads and highways, motels, fast-food restaurants, and suburbia. Mobility was not just cars, but parts manufacturers and suppliers, mechanics, taxis, buses, commuter railways, and, in time, metro-area airports.

The auto industry created millions of jobs and massive new profit pools. Three of the top ten highest incomes reported to the Internal Revenue Service in 1924 came from automobile-industry titans. These developments were more than just economic; they were social. People of all means increasingly came to fret about “keeping up with the Joneses” and strove to purchase new and better cars, across a proliferating range of makes and models. GM president Alfred Sloan called it “a car for every purse and purpose” and drove the cycle forward with “dynamic obsolescence.”

Part 2

Costs and consequences

But oh, those trade-offs. The consequences of traffic accidents are shattering. More than a million people are killed each year on global roadways; traffic injuries are a leading cause of death worldwide for people under 30; deaths from air pollution are increasing steadily worldwide in every geographic region; and carbon emissions, which had been plateauing in recent years, appear to be rising again.3 Even in cities with well-developed electrical grids and robust mass-transit systems, transportation can account for a quarter of carbon emissions (23 percent in New York City). In cities in the developing world, it’s even higher, such as in Rio de Janeiro (32 percent) and Mexico City (45 percent).4

Meanwhile, traffic congestion exacts a toll of 2 to 5 percent of national GDP, by measures such as lost time, wasted fuel, and increased cost of doing business. And it’s not just dollars and cents: longer commute times, brought on by congestion, correlate with lower life satisfaction and increase risk of anxiety, poor fitness, obesity, high blood pressure, and other physical maladies.

Suboptimal infrastructure adds to the burden, and the situation is getting worse. In the United States, where the transportation network arguably suffers from a “first-mover disadvantage,” many of the nation’s arteries are crumbling. In Europe, where infrastructure conditions can vary widely, large projects are becoming significantly more expensive and more difficult to “sell” to voters. Even in Asia, where in many respects the infrastructure is the newest in the world, rapid economic growth has led to transportation networks that are sometimes patchwork and often struggle to keep up.

What’s more, mobility may be reverting to two tiers, haves and have-nots. While e-hailing services seem to make on-demand mobility accessible to a broader share of the population, their customer demographic skews toward more educated, urban users, and, assuming one travels more than about 3,500 miles per year (as some 90 to 95 percent of US car owners do), the cost per mile can greatly exceed that of an owned car. Congestion pricing and for-pay fast lanes mean that only the wealthy enjoy unfettered use of their freedom machines. Parking access is restricted in some cities to those who live in certain districts; if you can’t afford to live there, you can be legally barred from parking there. The impediments are reinforced by tolls on roads and bridges and rising costs of public transportation and their governing authorities, which operate at a loss in any case.

Part 3

New frontiers for mobility innovation

A cluster of innovative forces are coming together with the potential to mitigate some of these costs and make the benefits even better. In many ways, of course, the automotive industry has always been an innovation engine. A car, never just a “metal box,” integrates multiple technologies—chemical, mechanical, electrical, and, increasingly, digital. Five years ago, the average high-end car already had roughly seven times more code than a Boeing 787. As we approach the next inflection point, cars will become productive data centers and, ultimately, components of a larger mobility network. That’s already evident in e-hailing and real-time, data-driven navigation systems. Those technologies are among the first crest of a rising wave of mobility innovations, which itself is the remarkable confluence of technological breakthroughs worldwide.

Because of remarkable leaps in computing power, data generation through sensors and cameras, and virtually free data storage, the probability of unprecedented automotive innovations hitting the market by 2030 is high. Blockchain is one striking example, with potentially multiple applications that could be game changers, including fare collection for robo-taxis, payments for tolls and parking, and a “golden record” of a vehicle’s ownership, maintenance, and usage history. Governments, for their part, are coming to demand that technological improvements be implemented to reduce emissions and increase safety. All US cars sold are now required to have rear-view cameras, and regulators are encouraging and even requiring other elements of advanced driver-assistance systems, or ADAS. Even without governmental pressure, carmakers are likely to innovate out of market-oriented self-preservation. McKinsey research finds that approximately two in five customers are willing to switch car brands for better connectivity features. That’s double the level of just four years ago.

Redefining what it means to be a ‘car person’

As the megatrends of autonomy, connectivity, electrification, and sharing transform mobility, they also are poised to shake up the automotive labor market. To get a sense of the likely impact, we reviewed employment across the automotive value chain in Europe and estimated potential gains and losses in jobs by 2030, as mobility’s second great inflection plays out. It appears that connectivity and autonomous driving will be net job creators. Electrification and manufacturing automation are more likely to result in job reductions as compared with the manufacturing of traditional internal-combustion-engine vehicles. Our best estimates suggest the losses will be mostly outweighed by the gains, and employment in European automotive manufacturing (both direct and indirect) might decrease by about 10 percent. This net impact results from an approximately 25 percent decrease in demand for mechanical engineers and an approximately 15 percent increase in demand for software, electrical, and electronics workers. What’s more, the automotive industry is at the same time transitioning into a mobility industry, and while jobs in manufacturing will decrease, the mobility industry could become a job engine for adjacent industries (for example, charging, grid expansion, 5G, control towers, renewable electricity and fuels, and advanced materials).

Clearly, though, the nature of that employment will change. As mechanically focused positions and low-skilled manufacturing roles decline, digital opportunities in areas such as electronics and software will soar. Already, one can grasp the imbalance. We reviewed the top 100 most preferred employers on LinkedIn for software talent; not a single automaker made the list, even though automobiles are already software-heavy and are becoming even more so.

Traditional auto players are beginning to move aggressively in response. “We know we need to enhance our software capabilities,” says Hau Thai-Tang, Ford’s head of global product development and purchasing. “One of the things we did to meet that need was an agreement with BlackBerry, where we hired 400 of their employees as it shifted out of the traditional handset business.” (For more, see “Ford’s evolving sense of self: An interview with Hau Thai-Tang.”)

The phone example is on point. Had you asked a child 25 years ago to draw a phone, chances are she would have scrawled out something similar to what her father or mother envisioned back in 1960: a fixed block, a cord, and a banana-shaped handpiece. Today: a slim rectangle, of course. Cars will undergo a similar, tech-fueled reimagination—changing from a mechanical transportation machine to a smart, connected, supercomputer on wheels—so of course our old notions of a “car person” as a mechanical engineer or an oil-smeared wizard with the internal-combustion engine will change.

About the authors

Timo Möller is a partner in McKinsey’s Cologne office, and Patrick Schaufuss is an associate partner in the Munich office

As the megatrends of autonomy, connectivity, electrification, and sharing transform mobility, they also are poised to shake up the automotive labor market. To get a sense of the likely impact, we reviewed employment across the automotive value chain in Europe and estimated potential gains and losses in jobs by 2030, as mobility’s second great inflection plays out. It appears that connectivity and autonomous driving will be net job creators. Electrification and manufacturing automation are more likely to result in job reductions as compared with the manufacturing of traditional internal-combustion-engine vehicles. Our best estimates suggest the losses will be mostly outweighed by the gains, and employment in European automotive manufacturing (both direct and indirect) might decrease by about 10 percent. This net impact results from an approximately 25 percent decrease in demand for mechanical engineers and an approximately 15 percent increase in demand for software, electrical, and electronics workers. What’s more, the automotive industry is at the same time transitioning into a mobility industry, and while jobs in manufacturing will decrease, the mobility industry could become a job engine for adjacent industries (for example, charging, grid expansion, 5G, control towers, renewable electricity and fuels, and advanced materials).

Clearly, though, the nature of that employment will change. As mechanically focused positions and low-skilled manufacturing roles decline, digital opportunities in areas such as electronics and software will soar. Already, one can grasp the imbalance. We reviewed the top 100 most preferred employers on LinkedIn for software talent; not a single automaker made the list, even though automobiles are already software-heavy and are becoming even more so.

Traditional auto players are beginning to move aggressively in response. “We know we need to enhance our software capabilities,” says Hau Thai-Tang, Ford’s head of global product development and purchasing. “One of the things we did to meet that need was an agreement with BlackBerry, where we hired 400 of their employees as it shifted out of the traditional handset business.” (For more, see “Ford’s evolving sense of self: An interview with Hau Thai-Tang.”)

The phone example is on point. Had you asked a child 25 years ago to draw a phone, chances are she would have scrawled out something similar to what her father or mother envisioned back in 1960: a fixed block, a cord, and a banana-shaped handpiece. Today: a slim rectangle, of course. Cars will undergo a similar, tech-fueled reimagination—changing from a mechanical transportation machine to a smart, connected, supercomputer on wheels—so of course our old notions of a “car person” as a mechanical engineer or an oil-smeared wizard with the internal-combustion engine will change.

About the authors

Timo Möller is a partner in McKinsey’s Cologne office, and Patrick Schaufuss is an associate partner in the Munich office

Tech titans are investing aggressively in mobility innovation. Tesla is stirring the pot. And traditional OEMs are raising their tech games and building partnership portfolios. Much of the activity revolves around automotive technologies known by the acronym ACES—vehicles that are autonomous, connected, electric, and shared (for a deeper look, see “The trends transforming mobility’s future”). It’s not just major players who are interested in ACES. McKinsey’s Start-up and Investment Landscape Analysis found that more than $200 billion has been invested in ACES technology since 2010. Add to that the R&D investments of OEMs and original-equipment suppliers—about $125 billion in 2017 alone—and you have the makings of a revolution in transportation, as well as the jobs associated with it (for more on the employment implications, see sidebar, “Redefining what it means to be a ‘car person’”). Here’s a snapshot of the innovation underway.

Autonomy

Autonomous-car technologies will soon transform what “riding” means. Autonomy, expressed along a framework from the Society of Automotive Engineers ranging from level 0 (full driver control at all times) to level 5 (the full-time performance by an automated driving system of all aspects of driving under all roadway conditions), is presently being pursued on two fronts. In the private space, we will see the introduction of working level-3 systems in several high-end vehicles in the next one to two years. In the commercial space, level-4 vehicles could cover 60 to 70 percent of all miles driven in markets such as the United States in the first half of the 2020s, provided that it comes with a remote backup for when the vehicle encounters a situation it cannot handle and needs human intervention. The actual market adoption, however, will take longer and will depend on further factors, such as regulation, customer preferences, and competitive landscape.

Connectivity

The technology for connectivity—what car riders experience along the way—is also poised for a breakthrough. Cutting-edge automobiles today can use a driver’s personal profile to access services on external digital platforms such as Android Auto and Apple CarPlay. Dramatic improvements will soon shift the connectivity experience from reactive to predictive. Occupants will be afforded personalized infotainment through voice and hand gestures—in effect, a dialogue with the vehicle to receive proactive recommendations on services and functions. By the early 2020s, connectivity systems will become a “virtual chauffeur,” in which cognitive artificial intelligence (AI) can anticipate and fulfill riders’ needs.

Your virtual chauffeur? By the early 2020s, cognitive artificial intelligence may adjust your car’s ambient temperature, suggest a stop at your favorite coffee house, or alert you to bargains available at nearby stores.

In time, so will the road. Sensors embedded in vehicles will communicate with traffic lights, street signs, and each other, allowing cars to travel much closer together and shortening travel times significantly. As weather conditions change and car volumes ebb and surge, routes will be optimized near instantaneously. More rational traffic flows will not only shorten travel time; they will also put less stress on bridges, tunnels, and highways, greatly reduce the frequency of road accidents, and save precious minutes for emergency vehicles speeding through.

Vehicle-control centers (VCCs) can greatly ease traffic, as well. Predominantly cloud-based and made possible by AI, VCCs will be the analog of air-traffic control centers. The number of autonomous-vehicle (AV) cars in traffic will depend upon how many vehicles a center can process, but the short answer is: a lot. And the number of passengers will exceed the number of passenger vehicles. That’s a function both of shared AVs being able to be utilized up to 80 percent of the time (versus the current 4 percent level for privately owned nonautonomous cars), and because of likely increases in pooling—shared rides with common pickup or drop-off points. With VCCs and other platforms for AI, shared trips can optimize locations to serve the greatest number of people more conveniently.

Electrification

Significant improvements in battery technologies and the use of renewables, plus evident regulatory will from many governments to impose regional and global carbon limits, means the likely end of ICE’s technology predominance. That spells new opportunities for those in the energy and metals and mining industries, among others. While government-funded subsidies for EVs are expected to be phased out over time in the United States, Europe, and China, electrification mandates appear here to stay. European regulators are actively working to reduce CO2 emissions of vehicles and ratchet up penalties for noncompliance. China is targeting seven million electric-car sales by 2025. Although the country’s targets have so far been more of a suggestion than a rule, we expect China to put in place enforcement mechanisms over the next decade, with insiders highlighting the potential intention to leapfrog the technical and manufacturing challenges of modern ICE drive trains.

Currently, absent subsidies, a typical entry-level luxury EV sedan costs a significant premium above the price of an ICE vehicle. Unsurprisingly, most consumers are not willing to pay it. The cost of EVs—largely (but not solely) a function of their batteries’ dollars per kilowatt-hour—will need to continue to decline substantially in order to generate the consumer pull essential for widespread EV adoption beyond specific EV-preferring segments and use cases.

Should that transpire, renewable energy is poised to help meet rising electricity demand. New solar power plants being contracted today are being bid at about one-tenth of the cost of solar plants just seven years ago. Even without dramatic improvements, if trends continue at their current pace, solar and wind energy could grow from 4 percent of power generation today to as much as 36 percent of global electricity supply by 2035. That growth trajectory would save $350 billion in resource expenditure.

Sharing

While ridesharing poses the risk of disintermediating OEMs from their customers, to date, the expense of ridesharing, and indeed all e-hailing, amounts to more than what many consumers will bear. Driver pay takes up much of the cost. If ridesharing AVs eventually remove the driver from the equation, they could make riding more affordable. As well, AVs (like taxis in New York City, which drive an average of 70,000 miles per year) will travel much more than the approximate 15,000 miles per year of privately owned vehicles. That will greatly lower the total cost of ownership due to lower variable cost, despite higher fixed cost (the original price of the car).

In addition, today’s automobiles are designed for a large number of use cases. Narrowing a car’s capabilities lowers its cost. More people e-hailing means one less major use case for OEMs to address, which will allow affordable, purpose-built vehicles to be introduced in turn. Shifting from “pay for vehicle” to “pay per mile” has the happy result of reducing the price of both.

Finally, advances in design should help overcome some potential riders’ understandable resistance to sharing rides with strangers; in-vehicle pods will allow for greater privacy, more engaging entertainment, and productivity capabilities that approach what one would have at the office.

Part 4

Social forces

Reinforcing digitization (which accounts for seamlessly new means of engaging with mobility services) and electrification (which will increasingly power vehicles) are social forces. Consider the change from understanding mobility as “buying a car” to “getting from A to B.” The transition will play out over horizons, with households likely first to scale down their number of cars before giving up on ownership entirely.

That couldn’t happen without deeper philosophical and demographic forces at work. While automobile ownership remains a powerful status symbol in key markets worldwide and global passenger-car production has increased at almost three times the rate of population growth from 1999 to 2016, there are signs that millennials and Generation Yers may be more open to different models of car use and ownership, less brand loyal, and less likely to place a premium on traveling for face-to-face meetings as opposed to interacting online. The past eight years have witnessed a decline in the percentage of Americans with a driver’s license across every age group, with those aged 16 to 19 (–11.8 percent) and 20 to 24 (–6 percent) falling off the most. As well, new-car purchases have been falling for every demographic of American consumers except for those over 70.

Changes in how people work also loom large. More people working from home translates to less commuting, which in turn reduces miles travelled and the need for an automobile. For many people, commuting is the main reason for owning a car in the first place. As alternatives to commuting emerge at the same time high congestion, unhealthy pollution levels, scarce housing, even scarcer parking, and substandard infrastructure make commuting less attractive, the impetus for car ownership diminishes.

Simultaneously, the will to fix our cities is getting stronger. Urban populations, historically at the vanguard for change, are already more receptive to solutions such as ridesharing and carsharing, as well as EVs. Oslo plans to ban cars in its city center this year. Madrid rolled out downtown car restrictions in November 2018 and plans to expand car-free zones considerably by 2020. And numerous German cities now ban older diesel vehicles. As cities pull countries forward, countries are adapting more consistent and more rigorous standards.

In many ways, the story of the automobile and the story of the 20th century were one and the same. It’s the story of progress, with all of its trade-offs: lower transportation costs, greater convenience, and a vastly superior consumer experience, as well as risks to human safety and deleterious effects on our shared environment. The new narrative taking shape tracks the same dimensions, none of which will be resolved perfectly but all of which will change rapidly for the better. So rapid, in fact, that the Second Great Inflection Point will soon be upon us. The implications for transportation, for the broadening array of companies that will help provide it, and for business and society as a whole will help define the 21st century, and are the focus of the article that follows.

About the author(s)

Rajat Dhawan is a senior partner in McKinsey’s Delhi office, Russell Hensley is a partner in the Detroit office, Asutosh Padhi is a senior partner in the Chicago office, and Andreas Tschiesner is a senior partner in the Munich office.”

Source: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/mobilitys-second-great-inflection-point

Português

Português