The CEO’s job is as difficult as it is important. Here is a guide to how the best CEOs think and act.

A company has only one peerless role: chief executive officer. It’s the most powerful and sought- after title in business, more exciting, rewarding, and influential than any other. What the CEO controls—the company’s biggest moves—accounts for 45 percent of a company’s performance. Despite the luster of the role, serving as a CEO can be all-consuming, lonely, and stressful. Just three in five newly appointed CEOs live up to performance expectations in their first 18 months on the job. The high standards and broad expectations of directors, shareholders, customers, and employees create an environment of relentless scrutiny in which one move can dramatically make or derail an accomplished career.

For all the scrutiny of the CEO’s role, though, little is solidly understood about what CEOs really do to excel. McKinsey’s longtime leader, Marvin Bower, considered the CEO’s job so specialized that he felt executives could prepare for the post only by holding it. Many of the CEOs we’ve worked with have expressed similar views. In their experience, even asking other CEOs how to approach the job doesn’t help, because suggestions vary greatly once they go beyond high-level advice such as “set the strategy,” “shape the culture,” and “get the right team.” Perhaps that’s not surprising—industry contexts differ, as do leadership preferences—but it illustrates that fellow CEOs don’t necessarily make reliable guides.

Nor has academic and other research on the CEO’s role done much to illuminate how CEOs think and what they do to excel. For example, recent studies that detail how CEOs spend their time don’t show the difference between a good use of time and a bad one. Academic research also demonstrates that traits such as drive, resilience, and risk tolerance make CEOs more successful. This insight is helpful during a search for a new CEO, but it’s hardly one that sitting CEOs can use to improve their performance. Other research has tended to produce such findings as the observation that leaders are effective in some situations and ineffective in others—interesting, but less than instructive.

With this article, we set out to show which mindsets and practices are proven to make CEOs most effective. It is the fruit of a long-running effort to study performance data on thousands of CEOs, revisit our firsthand experience helping CEOs enhance their leadership approaches, and extract a set of empirical, broadly applicable insights on how excellent CEOs think and act. We also offer a self- assessment guide to help CEOs (and CEO watchers, such as boards of directors) determine how closely they adhere to the mindsets and practices that are closely associated with superior CEO performance. Our hope is that all CEOs, new or long-tenured, can use these tools to better apply their scarce time and energy.

A model for CEO excellence

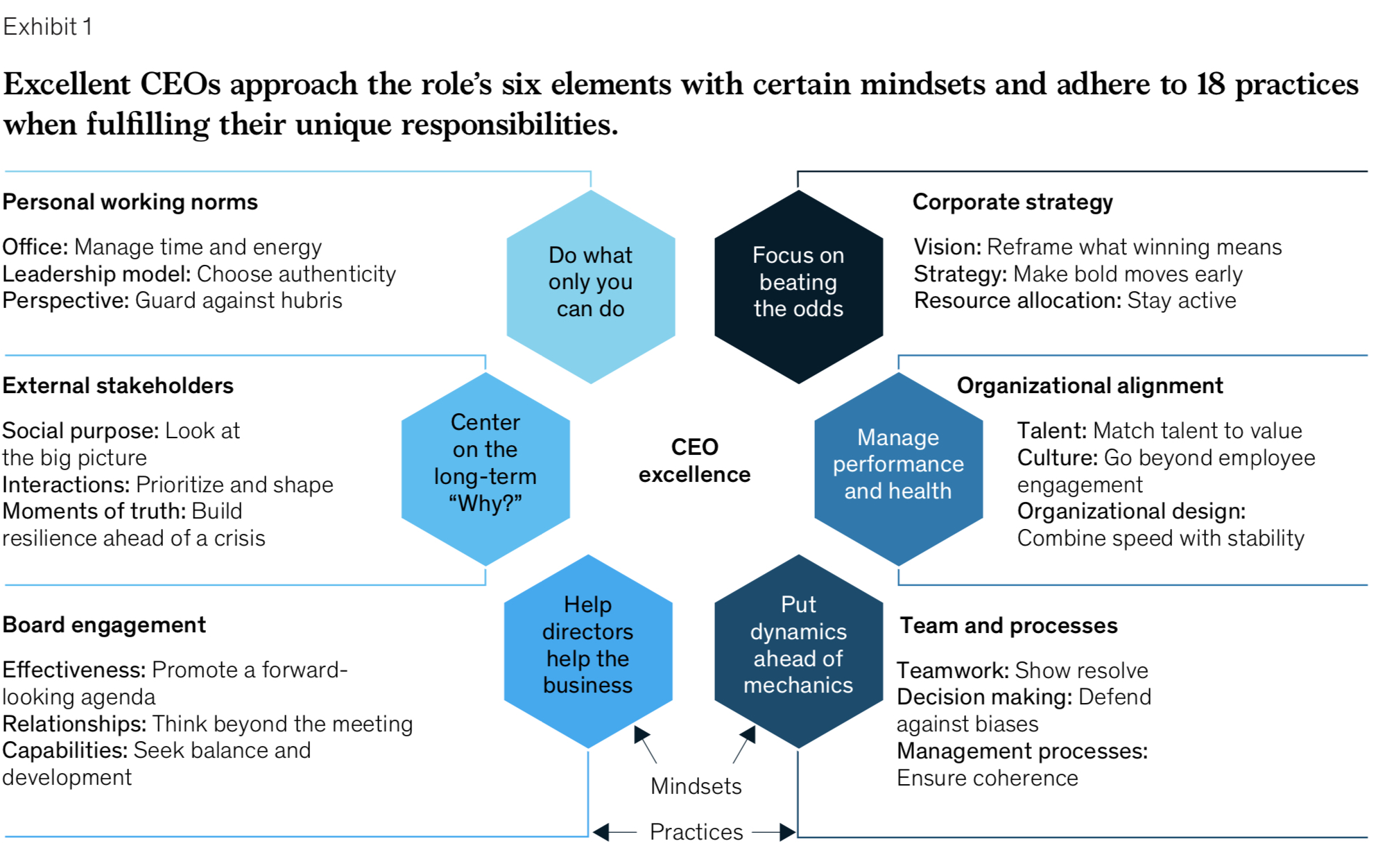

To answer the question, “What are the mindsets and practices of excellent CEOs?,” we started with the six main elements of the CEO’s job—elements touched on in virtually all literature about the role: setting the strategy, aligning the organization, leading the top team, working with the board, being the face of the company to external stakeholders, and managing one’s own time and energy. We then broke those down into 18 specific responsibilities that fall exclusively to the CEO. For example, setting a corporate strategy requires that the CEO make the final call on an overall vision, a set of strategic moves, and the allocation of capital.

Focusing on those 18 responsibilities, we conducted extensive research to determine what mindsets and practices distinguish excellent CEOs. We mined our proprietary database on CEO performance, which is the largest of its kind, containing 25 years’ worth of data on 7,800 CEOs from 3,500 public companies across 70 countries and 24 industries. We also drew on what we’ve learned from helping hundreds of CEOs to excel, from preparing for the job and transitioning into it, through navigating difficult decisions and moments of truth, to handing their responsibilities over to a successor.

The result of these efforts is a model for CEO excellence, which prescribes mindsets and practices that are especially likely to help CEOs succeed at their particular duties (Exhibit 1). What follows is a detailed look at these mindsets and practices. Although our findings are most relevant to CEOs of large public companies, owing to our research base, many will also apply to CEOs of other bodies, including private companies, public-sector organizations, and not-for-profit institutions.

Corporate strategy: Focus on beating the odds

It’s incumbent on the leader to set the direction for the company—to have a plan in the face of uncertainty. One way that CEOs try to reduce strategic uncertainty is to focus on options with the firmest business cases. Research shows, however, that this approach delivers another sort of outcome: the dreaded “hockey stick” effect, consisting of a projected dip in next year’s budget, followed by a promise of success, which never occurs. A more realistic approach recognizes that 10 percent of companies create 90 percent of the total economic profit (profit after subtracting the cost of capital), and that only one in 12 companies moves from being an average performer to a top-quintile performer over a ten-year period.3 The odds of making the jump from average to outstanding might be long, but CEOs can greatly increase the probability of beating those odds by adhering to these practices:

Vision: Reframe what winning means. The CEO is the ultimate decision maker when it comes to setting a company’s vision (where do we want to be in five, ten, or 15 years?). Good CEOs do this by considering their mandate and expectations (from the board, investors, employees, and other stakeholders), the relative strengths and purpose of their company, a clear understanding of what enables the business to generate value, opportunities and trends in the marketplace, and their personal aspirations and values. The best go one step further and reframe the reference point for success. For example, instead of a manufacturer aspiring to be number one in the industry, the CEO can broaden the objective to be in the top quartile among all industrials. Such a reframing acknowledges that companies compete for talent, capital, and influence on a bigger stage than their industry. It casts key performance measures such as margin, cash flow, and organizational health in a different light, thereby cutting through the biases and social dynamics that can lead to complacency.

Strategy: Make bold moves early. According to McKinsey research, five bold strategic moves best correlate with success: resource reallocation; programmatic mergers, acquisitions, and divestitures; capital expenditure; productivity improvements; and differentiation improvements (the latter three measured relative to a company’s industry). To move “boldly” is to shift at least 30 percent more than the industry median. Making one or two bold moves more than doubles the likelihood of rising from the middle quintiles of economic profit to the top quintile, and making three or more bold moves makes such a rise six times more likely.4 Furthermore, CEOs who make these moves earlier in their tenure outperform those who move later, and those who do so multiple times in their tenure avoid an otherwise common decline in performance.5

Not surprisingly, data also show that externally hired CEOs are more likely to move with boldness and speed than those promoted from within an organization.6 CEOs who are promoted from internal roles should explicitly ask and answer the question, “What would an outsider do?” as they determine their strategic moves.

Resource allocation: Stay active. Resource reallocation isn’t just a bold strategic move on its own; it’s also an essential enabler of the other strategic moves. Companies that reallocate more than 50 percent of their capital expenditures among business units over ten years create 50 percent more value than companies that reallocate more slowly.7 The benefit of this approach might seem obvious, yet a third of companies reallocate a mere 1 percent of their capital from year to year. Furthermore, research using our CEO database found that the top decile of high performing CEOs are 35 percent more likely to dynamically reallocate capital than average performers. To ensure that resources are swiftly reallocated to where they will deliver the most value rather than spread thinly across businesses and operations, excellent CEOs institute an ongoing (not annual) stage-gate process. Such a process takes a granular view, makes comparisons using quantitative metrics, prompts when to stop funding and when to continue it, and is backed by the CEO’s personal resolve to continually optimize the company’s allocation of resources.

Organizational alignment: Manage performance and health with equal rigor

Ask successful investors what they look for in portfolio companies, and many will tell you they’d rather put money on an average strategy in the hands of great talent than on a great strategy in the hands of average talent. The best CEOs put equal rigor and discipline into achieving greatness on both strategy and talent. And when it comes to putting great talent in place, almost half of senior leaders say that their biggest regret is taking too long to move lesser performers out of important roles, or out of the organization altogether.8 The reasons for this are both practical (good leaders provide the CEO with important leverage) and symbolic (CEOs who tolerate poor performance or bad behavior diminish their own influence). Many CEOs also say they regret leaving adequate performers in key positions and failing to realize the full potential of their roles. The best CEOs think systematically about their people: which roles they play, what they can achieve, and how the company should operate to increase people’s impact.

Talent: Match talent to value. Many CEOs have confided to us that they worry about asking the same few overstretched “usual suspects” to take extra assignments because they can’t trust the people who would otherwise perform them. The best CEOs take a methodical approach to matching talent with roles that create the most value.9 A crucial first step is discovering which roles matter most. Careful analysis typically produces findings that surprise even the savviest CEOs. Of the 50 most value-creating roles in any given organization, only 10 percent normally report to the CEO directly. Sixty percent are two levels below, and 10 percent sit farther down. Most surprising of all is that the remaining 10 percent are roles that don’t even exist.10 Once these roles are identified, the CEO can work with other executives to see that these roles are managed with increased rigor and are occupied by the right people. Robust talent pipelines can also be developed so that important roles remain well staffed. The best CEOs ensure that their own role is included so that the board has viable, well-prepared internal candidates to consider for succession.

Culture: Go beyond employee engagement. Vendors of workforce surveys like to say that employee engagement is the best measure of “soft stuff.” It’s not. While employee engagement indeed correlates with financial performance, a typical engagement survey covers less than 20 percent of the organizational-health elements that are proven to correlate with value creation. A proper assessment of organizational health takes in everything from alignment on direction and quality of execution to the ability to learn and adapt. In the largest research effort of its kind, McKinsey found that CEOs who insist on rigorously measuring and managing all cultural elements that drive performance more than double the odds that their strategies will be executed. And over the long term, they deliver triple the total return to shareholders that other companies deliver.11 Doing this well involves thoughtful approaches to role modeling, storytelling, aligning of formal reinforcements (such as incentives), and investing in skill building.

Organizational design: Combine speed with stability. “Agility” is one of most widely used and misunderstood management buzzwords of the past decade. For many leaders, agility evokes speed in decision making and execution, as opposed to the deliberate pace dictated by the stable, standardized routines of large organizations. The facts show that agility requires no such trade-off: on the contrary, companies that are both fast and stable are nearly three times more likely to rank in the top quartile of organizational health than companies that are fast but lack stable operating disciplines.12 Excellent CEOs increase their companies’ agility by determining which features of their organizational design will be stable and unchanging (such features might include a primary axis of organization, a few signature processes, and shared values) and by creating dynamic elements that adapt quickly to new challenges and opportunities (such elements might include temporary performance cells, flow-to- work staffing models, and minimum-viable-product iterations). A services company CEO, for example, better enabled her “one company” strategy by shifting the profit-and-loss axis from products to geographies, reorganizing the back office according to an agile flow-to-work model, and creating a new agile product development group.

Team and processes: Put dynamics ahead of mechanics The dynamics of a top team can strongly influence a company’s success. Yet more than half of senior executives report that the top team is underperforming. The CEO is often out of touch with this reality: on average, less than one-third of CEOs report problems with their teams.13 The efficiency and effectiveness of a company’s core management processes also can change a company’s fortunes, yet less than a third of employees report that their company’s management processes support the achievement of business objectives.14 Why the disconnect? The problem is not an intellectual one, but a social one: individual and institutional biases and clunky group dynamics can diminish with the effectiveness of the team and its processes. Excellent CEOs acknowledge this reality and counteract it in several ways.

Teamwork: Show resolve. The best CEOs take special care to ensure their management team performs strongly as a unit. The reward for doing so is real: top teams that work together toward a common vision are 1.9 times more likely to deliver above-median financial performance.15 In practice, CEOs swiftly adjust the team’s composition (size, diversity, and capability), which can involve hard calls on removing likeable low performers and disagreeable high performers and on elevating people with high potential. CEOs should also calibrate individual relationships, maintaining the distance to be objective but enough closeness to gain trust and loyalty. Further, they commit to making the team productive by regularly taking stock of and improving its operating rhythm, meeting protocols, interaction quality, and dynamics. They also firmly prohibit members from putting their interests ahead of the company’s needs, holding discussions that consist of “theater” rather than “substance,” “having the meeting outside the room,” backsliding on decisions, or showing disrespect for one another.

Decision making: Defend against biases. Cognitive and organizational biases worsen everyone’s judgment. Such biases contribute to many common performance shortfalls, such as the significant cost overruns that affect 90 percent of capital projects.16 We also know that biases cannot be unlearned. Even behavioral economist Dan Ariely, one of the foremost authorities on cognitive biases, admits, “I was just as bad myself at making decisions as everyone else I write about.”17 Nevertheless, CEOs sometimes feel as though they’re immune to bias (after all, they might ask, hasn’t good judgment gotten them where they are?). Excellent CEOs endeavor to minimize the effect of biases by instituting such processes as preemptively solving for failure modes (premortems), formally appointing a contrarian (red team), disregarding past information (clean sheet), and taking plan A off the table (vanishing options).18 They also ensure they have a diverse team, which has been shown to improve decision-making quality.19

Management processes: Ensure coherence. The CEO typically delegates management processes to other executives: the CFO looks after budgeting and sometimes strategy as well; the chief human resources officer (CHRO) looks after talent management and workforce planning; the CIO looks after technology investment; and so on. However, sensible individual processes can cohere into a clumsy system that results in more confusion and wasted effort than accountability and value. Managers pushed to agree to stretch targets find at year’s end that they are being held accountable for full delivery; sandbagging ensues. Long-term strategies are set, yet talent promotions are based on near-term results. Urgent product ideas are approved, only to get bogged down in long technology queues and one-size-fits-all risk-management processes. Excellent CEOs don’t allow one management process to foil another. They require executives to coordinate their decision making and resource assignments to ensure that management processes reinforce priorities and work together to propel execution and continual refinement of the strategy.

Board engagement: Help directors help the business

The board’s mission on behalf of shareholders is to oversee and guide management’s efforts to create long-term value. Research shows that sound corporate governance practices are linked with better performance, including higher market valuations.20 An effective board can also repel activist investors. Despite these upsides, many CEOs regard their companies’ boards in the way one CEO described his company’s board to us: as a “necessary evil.” The chairperson leads the board, and even in cases where that role is held by the CEO (as is common in North American companies), the board’s independence is essential. Nevertheless, excellent CEOs can take useful steps to boost the quality of the board’s advice to management such as the following:

Effectiveness: Promote a forward-looking

agenda. To get the most from their time with the board, excellent CEOs collaborate with board chairs on developing a forward-looking board agenda. Such an agenda calls for the board to go beyond its traditional fiduciary responsibilities (legal, regulatory, audit, compliance, risk, and performance reporting) and provide input on a broad range of topics, such as strategy, M&A, technology, culture, talent, resilience, and external communications. Board members’ outside views on these topics can help management without compromising executives’ authority. In addition, the CEO should make sure that the board and management take up related activities, such as reviewing talent and refreshing the strategy, at the same times of year.

Relationships: Think beyond the meeting. Excellent CEOs develop and maintain a strong relationship with the chair (or lead independent director) and hold purposeful meetings with individual board members. Establishing good relationships and a tone of transparency early on enables the CEO to build trust and to clearly delineate responsibilities between management and the board. Building relationships with individual board members positions the CEO to benefit from their perspectives and abilities, and privately discuss topics that may be difficult for the larger group to address. Excellent CEOs also promote connections and collaboration between the board and top executives, which keeps the board informed about the business and engaged in supporting its priorities.

Capabilities: Seek balance and development.

Excellent CEOs also help their boards help the business by providing input on the board’s composition. For example, the CEO might suggest that certain types of expertise or experience—be they related to industries, functions, geographies, growth phases, or demographics—would enable the board to better assess and support the business. CEOs can also help improve the board’s effectiveness by ensuring that new members complete a thorough onboarding program and creating opportunities for the board to learn about topics like changing technology, emerging risks, rising competitors, and shifting macroeconomic scenarios. First-time board members usually benefit from a structured introduction to what it means to be an effective board member.

External stakeholders: Center on the long-term ‘Why?’

Every CEO should know their company’s mission and values. Good CEOs know that these statements need to amount to more than slogans for office posters and use them to influence decision making and day-to-day behaviors. Excellent CEOs go further: they reinforce and act on a corporate purpose (the “Why?”) that involves not just making money but also benefiting society. This posture, along with a granular approach to prioritizing stakeholder interactions and a sound corporate resilience plan, lets CEOs minimize the company’s exposure to customer- and stakeholder-related risks, and capitalize on new opportunities.

Social purpose: Look at the big picture. Many corporate social responsibility programs are little more than public-relations exercises: collections of charitable initiatives that generate good feelings but have minimal lasting influence on society’s well-being. Excellent CEOs spend time thinking about, articulating, and championing the purpose of their company as it relates to the big-picture impact of day-to-day business practices. They push for meaningful efforts to create jobs, abide by ethical labor practices, improve customers’ lives, and lessen the environmental harm caused by operations. Visible results matter to stakeholders; for example, 87 percent of customers say that they will purchase from companies that support issues they care about, 94 percent of millennials say that they want to use their skills to benefit a cause, and sustainable investing has grown 18-fold since 1995.21 And not demonstrating such results isn’t an option—wise CEOs know they will be held to account for fulfilling their promises.

Interactions: Prioritize and shape. Excellent CEOs systematically prioritize, proactively schedule, and use interactions with their companies’ important external stakeholders to motivate action. CEOs of B2B companies typically focus on their highest- value and largest potential customers. CEOs of B2C companies often like to make unannounced visits to stores and other frontline operations to better understand the customer experience that the business provides. They also spend time with their companies’ 15 or 20 most important “intrinsic” investors (those who are most knowledgeable and engaged) and assign the rest to the CFO and the investor-relations department.22 Other stakeholder groups (such as regulators, politicians, advocacy groups, and community organizations) also will require a portion of the CEO’s time. The efficacy of these interactions isn’t left to chance. Excellent CEOs know what they want to accomplish, prepare well, communicate audience-tailored messages (always centered on their company’s “Why?”), listen intently, and seek win–win solutions where possible.

Moments of truth: Build resilience ahead of a crisis. Good CEOs ensure that their companies have an effective risk operating model, governance structure, and risk culture. Great CEOs and their boards also anticipate major shocks, macroeconomic events, and other potential crises. There’s good reason to do this: headlines that carried the word “crisis” alongside the names of 100 top companies appeared 80 percent more often from 2010 to 2017 than they did in the previous decade.23 Excellent CEOs recognize that most crises follow predictable patterns even though each one feels unique. With that in mind, they prepare a crisis- response playbook that sets out leadership roles, war-room configuration, resilience tests, action plans, and communications approaches. They seek opportunities to go on the offensive, to the extent they can.24 And they know that stakeholders’ anger will likely center on them, in ways that can affect their family and friends, and accordingly develop a personal resilience plan.

Personal working norms: Do what only you can do

CEOs can easily become overwhelmed, which is understandable given the sheer breadth of their role. As the dean of Harvard Business School, Nitin Nohria, has said, “CEOs are accountable for all the work of their organizations. Their life is endless meetings and a barrage of email.”25 Plenty of research also suggests that many CEOs are beset by loneliness, frustration, disappointment, irritation, and exhaustion. While no CEO can escape these emotions completely, excellent CEOs know that they will serve the company better by taking command of their well-being in these ways:

Office: Manage time and energy. The most successful CEOs quickly establish an office (often including one or two highly skilled executive assistants and a chief of staff) that makes their priorities explicit and helps them spend their scarce time doing work that only CEOs can do. For example, a CEO’s office should carefully plot all aspects of the CEO’s meetings: agenda, attendees, preparation (including “alone time” for the CEO to reflect and get ready), logistics, expected outcomes, and follow-up. CEOs should limit their involvement in tasks that can be dealt with by others and reserve time to deal with unexpected developments. The best CEOs also teach their office staffs to help manage the CEO’s energy as thoughtfully as their time, sequencing activities to prevent “energy troughs” and scheduling intervals for recovery practices (for example, time with family and friends, exercise, reading, and spirituality). Doing so ensures that CEOs set a pace they can sustain for a marathon-length effort, rather than burn out by sprinting over and over.

Leadership model: Choose authenticity. Exemplary CEOs combine the reality of what they ought to do in the role with who they are as human beings. They deliberately choose how to behave in the role, based on such questions as: What legacy do I want to leave? What do I want others to say about me as a leader? What do I stand for? What won’t I tolerate? CEOs answer these questions according to their strengths and motivations, as well as the company’s needs, and create mechanisms to track how they are doing. Further, by expressing these intentions as part of the rationale for their decisions and actions, CEOs can minimize the risk of unintended interpretations being amplified in unhelpful ways. The importance of this can’t be underestimated. As a consumer goods CEO told us, “You are speaking through an extraordinary amplification system. The slightest thing you do or say is picked up on by everyone in the system and, by and large, acted on.”

Perspective: Guard against hubris. It’s easy for CEOs to become overconfident. While they must push ahead in spite of naysayers at times, they can also tune out critics once they learn to trust their own instincts. Their conviction can increase because subordinates tend to say only what bosses want to hear. Before long, CEOs forget how to say “I don’t know,” cease asking for help or feedback, and dismiss all criticism. Excellent CEOs form a small group of trusted colleagues to provide discreet, unfiltered advice—including the kind that hasn’t been asked for but is important to hear. They also stay in touch with how the work really gets done in the organization by getting out of boardrooms, conference centers, and corporate jets to spend time with rank-and-file employees. This is not only grounding for the CEO, but also motivating for all involved. Finally, excellent CEOs keep their role in perspective by reminding themselves it is temporary and does not define or limit their self- worth and importance in the world. Whereas Steve Jobs advised college graduates, “Stay hungry, stay foolish,” we urge CEOs to “Stay hungry, stay humble.”

Gauging CEO excellence

CEOs have many ways to gauge how well they are doing in their role. A criterion used in virtually every “best CEO” ranking for public companies is how much value a CEO’s company creates. Value creation makes it possible to sustain the pursuit of other goals. But financial measures of CEO excellence have a serious shortcoming: they are heavily influenced by factors outside the CEO’s control. For example, the “endowment” a CEO inherits (for example, the company’s revenue base, debt levels, and past investments in R&D) accounts for 30 percent of what enables a company to move from average to the top quintile of economic profit. Industry and geographic trends account for 25 percent.

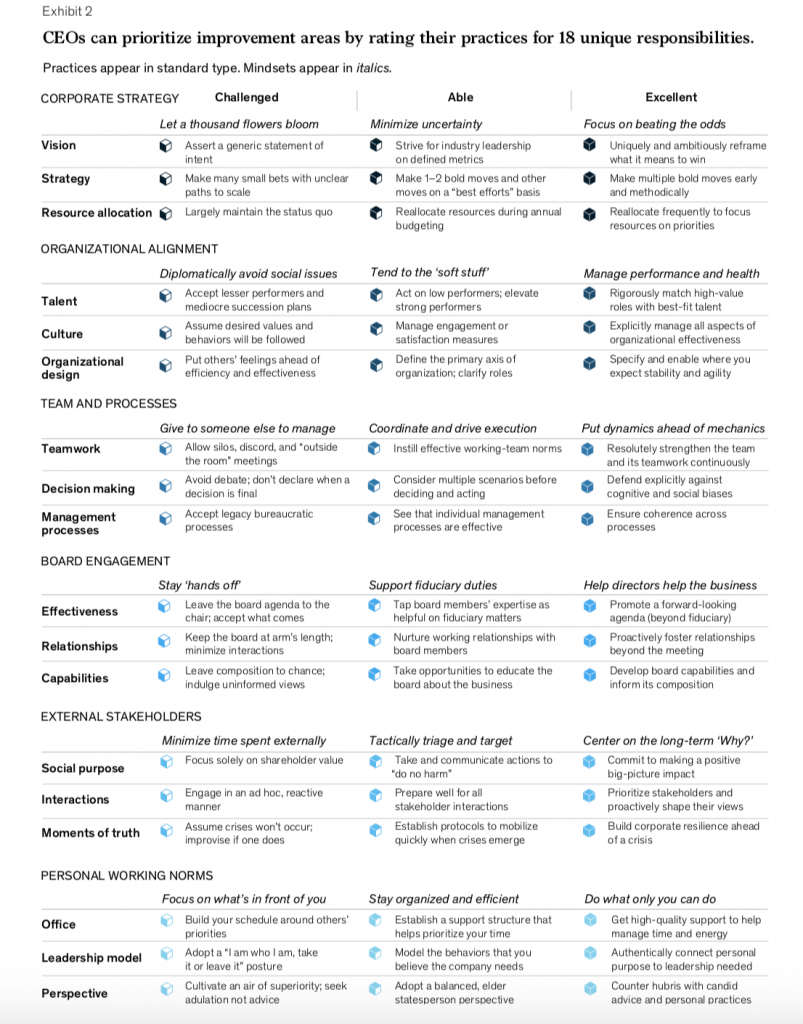

The remaining 45 percent that the CEO can control is what we’ve endeavored to illuminate in our model of CEO excellence. The gap between excellent CEOs and lesser ones is wide, as many directors know firsthand (analysis of our CEO database shows that 30 percent of top-performing CEOs take over from bottom-performing ones and 23 percent of bottom-performing CEOs take over from top performers). One thing to keep in mind: we are not suggesting that an excellent CEO is one who excels at every one of their 18 unique responsibilities. In fact, we’ve yet to meet one who does. Rather, we’ve observed that the best CEOs are ordinarily excellent in a few areas, able in all others, and challenged in none. The more areas a CEO excels in, the better their results tend to be.

What’s more, the emphasis that CEOs should place on individual responsibilities will change over time. Time spent setting the corporate strategy early in a CEO’s tenure will normally give way to fine-tuning and driving execution, and then to highlighting tangible results that build credibility with stakeholders. At some point, however, it becomes important to look at the company with fresh eyes and to decide on the next set of bold moves, realign the organization, refresh the team and processes, and so on. To help CEOs figure out where they stand with respect to the mindsets and practices described in this article, we developed the assessment guide in Exhibit 2.

Leadership matters—and no leader is more important than the leader of leaders. Executives who are appointed to the top job can boost their leadership capabilities by understanding and adopting the mindsets and practices that define CEO excellence.

1 Chris Bradley, Martin Hirt, and Sven Smit, Strategy Beyond the Hockey Stick: People, Probabilities, and Big Moves to Beat the Odds, Hoboken, NJ: John Wiley & Sons, 2018.

2 Eben Harrell, “Succession planning: What the research says,” Harvard Business Review, December 2016, pp. 70–74, hbr.org.

3 Chris Bradley, Martin Hirt, and Sven Smit, Strategy Beyond the Hockey Stick: People, Probabilities, and Big Moves to Beat the Odds, Hoboken, NJ: John Wiley & Sons, 2018.

4 Ibid.

5 Michael Birshan, Thomas Meakin, and Kurt Strovink, “What makes a CEO ‘exceptional’?,” McKinsey Quarterly, April 2017, McKinsey.com. Michael Birshan, Thomas Meakin, and Kurt Strovink, “How new CEOs can boost their odds of success,” McKinsey Quarterly, May 2016, McKinsey.com.

Chris Bradley, Martin Hirt, and Sven Smit, Strategy Beyond the Hockey Stick:

7 People, Probabilities, and Big Moves to Beat the Odds, Hoboken, NJ: John Wiley & Sons, 2018.

8 “How to beat the transformation odds,” April 2015, McKinsey.com.

by Carolyn Dewar, Martin Hirt, and Scott Keller

Português

Português