Pace and power go hand in hand for digital leaders, which typically run four times faster and pull critical strategic levers two times harder than other companies do.

Most executives we know have a powerful, intuitive feel for the rhythm of their businesses. They know how hard and fast to pull strategic levers, move their organization, and drive execution to achieve their objectives. Or at least they did. Digitization has intensified the rhythm of competition in many industries, leaving executives adrift, with information-gathering systems that are too slow or disconnected, direction-setting approaches that are too timid, and talent- management norms that are misaligned and incremental.

These leaders know their companies must adjust and accelerate. Digital is putting pressure on profit pools as it transfers an increasing share of value to consumers. Furthermore, those profit pools are bleeding across traditional industry lines as advanced technologies enable companies to forge into adjacencies, changing who in the value chain is making money, what share of the pie they capture, and how. The slow and inefficient are left behind, competing for scraps.

What is unclear to these executives, however, is how much and how fast to adapt their business rhythms. The exhortation to “change at the speed of digital” generates more anxiety than answers. We have recently completed some research that provides clear guidance: digital leaders appear to keep up a drumbeat in their businesses that can be four times faster, and twice as powerful, as those of their peers.

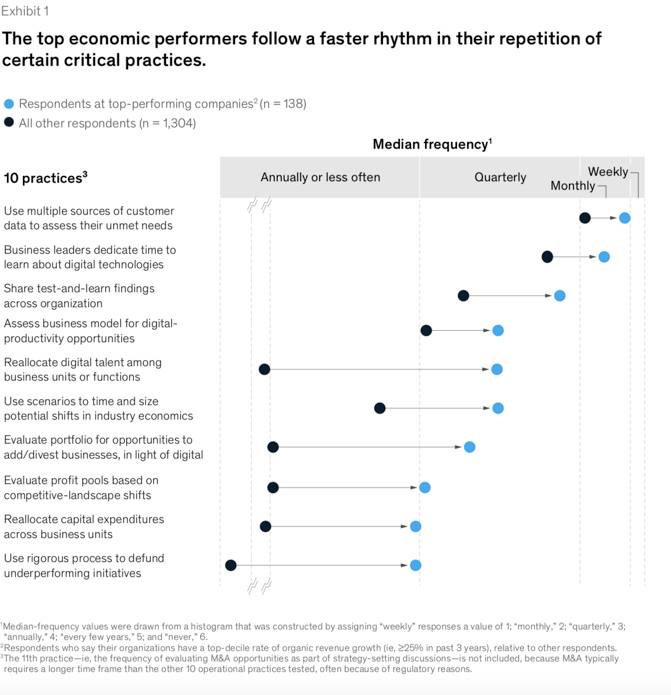

In earlier studies, we identified 11 strategic and operational practices that are tightly correlated with the successful execution of digital efforts. More recently, we

asked more than 1,500 executives how frequently their companies carry out these 11 practices.1

The responses of the best-performing companies—those in the top decile for organic revenue growth—suggest that the accelerated repetition of certain critical practices is closely associated with adaptive cultures that are comfortable with change, learning all the time, and swiftly responsive (Exhibit 1).

These practices fall into two different categories. One is a set of actions that a company must take continuously (monthly, or even weekly) to increase the pulse of the organization. The other is a set of activities done intermittently (often quarterly) and involves taking a step back to review all that the company has learned, as well as making powerful adjustments or realignments accordingly (see sidebar, “Faster and harder: Behind the numbers”).

Moving four times faster: The beat of the company

You can’t quicken the pace of an organization by fiat. You have to build it by accelerating the frequency of manageable practices that are integral to achieving key goals, such as serving the customer or driving internal efficiency. These “light-touch” actions are low risk and low investment, but they can provide high-yield returns. We have grouped them into two buckets that can help mold incumbents into digital players.

Learn, engage, and share

How often does your organization analyze customer data to look proactively for new ways of delighting your customers? How frequently do your senior business leaders take time to investigate and understand new digital technologies so that they recognize which ones are truly relevant to their areas of the business? How quickly and consistently does your company share lessons acquired from test-and-learn experiments performed by those on the front lines? If you are like most organizations, you aren’t performing these tasks fast enough:

● Learning: From quarterly to monthly. Top-performing companies are voracious opportunists, and it starts at the top. Senior leaders take time to tune up their understanding of the digital tools and practices their businesses need to stay ahead. That happens monthly (often, more frequently) at the best performers, compared with quarterly at the lower performers. Much faster than average companies, top companies scan for digitally enabled productivity opportunities and for external-environment shifts that are changing the economics and boundaries of their businesses.

● Engaging with data: From monthly to weekly. Nearly half (44 percent) of digital leaders collect and analyze customer data weekly (or more frequently) to identify new ways of winning over buyers, compared with just 16 percent of laggards, which, on average, dig into customer data only monthly. And the drive for urgency is omnipresent. A company with a database of 2,000 customers, for example, decided to generate online sales by offering a discount code. Instead of simply sending a single email to its customers, it tested two different promotional offers, one demanding faster action from customers than the other. The more time-sensitive offer generated a 60 percent higher response rate, which became the standard for future promotional emails.

● Sharing results: From quarterly to monthly—or even weekly. To ensure that results such as those in the previous example permeate the organization, top-performing companies encourage employees to share their lessons from lower-performing tests and successes from better-performing ones. As basic as this practice might seem, top-decile performers are five times more likely than others to do this weekly.

And top performers are committed to sharing with the broader organization what has been gleaned from any test-and-learn activities. They do this about three to four times faster than their peers do—at least monthly, rather than the quarterly frequency seen in other companies—with the very highest performers sharing knowledge weekly.

Why do these particular actions matter so much? As Gandhi said, “Your actions become your habits; your habits become your values; your values become your destiny.” It goes back to the elements of organizational culture—risk taking, customer focus, silo busting—that our past research has highlighted as core to digital effectiveness. Focusing on frequent inputs about what your customers are wanting, and how new technologies can help you deliver that, drives both a more customer- centric view and a greater confidence about what direction to take new offers. Sharing insights about what is working and what is not beyond the team that launched a particular initiative helps break down siloed views of both the business and the customers, and it can spur calculated risk taking in other parts of the organization. As Gandhi knew well, small but frequent actions can lead to big and meaningful changes.

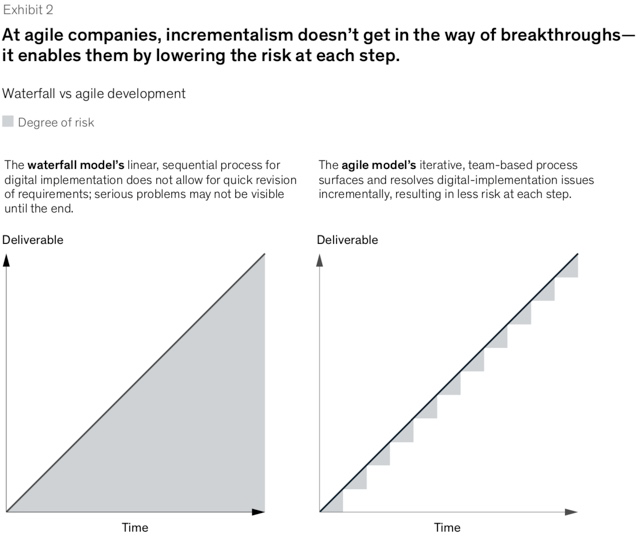

Adapt and deploy

The top-performing companies in our survey are just as opportunistic when it comes to redistributing talent. This often comes through the formation, dissolution, reformulation, and work of agile teams, whose many small, low-risk steps enable swift progress, rapid talent reallocation, and massive change (Exhibit 2). At agile companies, incrementalism enables breakthroughs by lowering the risks at each step:

● Talent reallocation: From yearly to quarterly. On average, leading companies reallocate digital talent more than five times faster than their peers do, doing so on a quarterly or faster basis. Most companies wait a year or more to reallocate talent. This large spread is likely to grow as more companies expand their use of agile methodology beyond IT. Agile ensures that organizations bring together small multidisciplinary teams aligned on common goals. These groups make iterative progress on—and continuously manage their backlogs of—those activities that matter most in achieving critical outcomes. Their work enables rapid, large-scale reprioritization of digital initiatives and has the added merit of lowering the risk on bold moves.

● Agility in action: From every two months to every two weeks. At the Dutch banking group ING, for example, an agile workplace has allowed the company to reinvent the way it serves customers. People increasingly use a variety of channels for financial services: branches, smartphone apps, laptops. They want every one of those experiences to be seamless.

Agility accelerates everything. Cross-functional “squads” of nine people or fewer focus on delivering solutions for specific needs of their customers in ways that were impossible in the old organization. Squads with a shared overarching mission (such as mortgages, payments, or consumer credit) are united in “tribes” of 150 employees or fewer. Reallocation of talent is executed swiftly, with focus on value. Each tribe is headed by a lead who can deliver key resources, including IT engineers, as needed. These tribe leaders convene once a quarter in a quarterly business review (QBR). Before the QBR, tribe leaders share a brief memo with all of their peers, documenting what the tribe achieved in the past three months, as well as what it was unable to accomplish and why. They also share, in writing, their commitments for the coming quarter and document the resources and support they require to achieve these ambitious goals. Based on this input and related conversations, the bank’s top management reallocates talent to the tribes with the greatest opportunities. The process has unleashed creativity and productivity. At the beginning of the journey, ING could only deliver four new software releases a year, a pace that would have

left it hopelessly behind its customers. These days, ING delivers new software on an ongoing basis, at an astonishing rate of more than 20,000 small releases per month.

Driving your strategy with twice the power

Our survey findings make clear that digital leaders undertake big strategic initiatives more often—and more successfully—than their peers do. They are more likely to develop entirely new digital offerings or to launch new businesses.2 Their digital transformations are more likely to be deep, organization-wide efforts than experiments conducted on the fringes.

Big moves that turbocharge digital effectiveness are underpinned by strategic clarity and adaptability. The two go hand in hand because keen insights and a view of the future are more powerful when combined with learning through experimentation. Companies with both have the confidence to make big calls when others are frozen in wait-and-see mode.

Two of the most important such calls are major acquisitions and capital bets. Not only are these two of the five big moves shown by our colleagues in separate research3 to be the greatest contributors to exceptional corporate-performance improvement, they also loomed large in our findings—powerful differentiators that separated digital leaders from laggards:

● Our survey suggests that digital leaders spend three times more on M&A (27 percent of annual revenue, compared with 9 percent spent by others) and dedicate more than 1.5 times more of their M&A activity to the acquisition of digital capabilities and digital businesses (64 percent, compared with 39 percent for their peers). Taken together, those results suggest that the leaders are pursuing digital M&A about twice as hard, on average, as everyone else.

● Digital winners typically allocate 9 percent of their capital expenditures toward digital-transformation efforts, while others allocate half that much—again, twice the power for digital leaders. The results are transformative as well: expenditures that lead to better analytics tools or greater automation can be key in building competitive advantage over digital competitors.

Strategic power and rapid pace are mutually reinforcing. When digital leaders

launch initiatives at a greater rate than peers do, they create opportunities to collect

data, analyze them, and learn faster than other companies. That learning about the

evolution of markets, consumer attitudes, and behavior, in turn, sets those companies

up to make bigger, better, faster acquisition and capital-expenditure decisions—

which, in turn, fuel new initiatives and more learning.

Accelerating the digital drumbeat: A checklist for companies

The speed and power with which digital leaders move are best illustrated through examples. So let’s examine a group of financial-services players that dramatically increased the rhythm of their business in response to emerging digital challenges. One company, which had performed well by steadily improving productivity, was seeing leaner digital players cherry-pick its clients, forcing consideration of radical digital interventions to its core business model. Another company had seen its portfolio of new, B2C businesses, which delivered the highest profit growth in the company, getting hammered in the press for poor customer experience and unimaginative offerings.

The CEO and heads of the business lines in these organizations agreed something had to be done—they just weren’t sure what. To accelerate learning, one company empowered a new group to examine the end-to-end journeys of their customers and built out an insights and analytics group to uncover unmet needs. This gave the company the knowledge it needed to do a cleansheet redesign of its current offerings and to create some new ones. Another company launched a tech-enabled productivity transformation of its core business, aimed at embedding artificial intelligence and automating a variety of functions. The direction was starting to crystallize for these organizations. But the companies needed to take five interrelated actions to support their digital goals.

1. Seeking real-time digital learning

The executive teams knew that their business leaders, while familiar with the basics

of digital, needed to become both deeply knowledgeable about the advanced

technologies their units were starting to deploy and able to think, in real time, about

the strategic implications of technologies and tools. Robotics, for example, was no

longer about building machines but about automating the assembly of digital apps

that would be immensely important to ongoing customer interactions. This raised

important questions: If you can automate 10 percent of 100 app-creation jobs, do

you simply save the full-time equivalent of ten people, or do you redeploy them to

other digital thrusts, perhaps in other areas of the organization? And how do you align

executive incentives behind such resource shifting?

Rather than inundate business leaders with educational material, one organization launched a cross-functional initiative to discover jointly how AI-supported robotic process automation could boost productivity, drive down cost, and expand strategic options. Cross-functional teams cocreated pilots and shared their models, assumptions, and findings in monthly meetings attended by the business leaders, including those whose headcounts were in question. This practical and open approach simultaneously gave key leaders a valuable education in the potential of digital and crafted consensus around resource reallocation.

2. Sharing insights at the pace of digital

The companies had plenty of algorithms to identify inefficiencies but did a poor job of turning the tremendous amount of data they had—about interactions with customers and how customers used (or didn’t use) its products—into valuable insights that could lead to new and better products and services. Part of the problem had to do with technology: the companies lacked key algorithms in customer-facing areas.

But another part of it was the result of an organizational weakness. Droves of

customer insights were trapped in silos. The operations teams had information on

which customer issues pushed up costs. The marketing teams had insights into

what drove or lost sales. Channel partners had data on why customers had chosen a

competitor’s offering. Not only were the insights siloed in disconnected groups, but

when data in one silo contradicted data in another, nothing was done to reconcile the

findings, meaning that divisions were sometimes working at cross-purposes.

With the backing of the CEO, one executive team instituted a quarterly check-in across the businesses to identify top customer pain points coming in from their websites, call centers, and product-usage databases. As people across the company came to see the value of these check-ins, meetings started occurring monthly or even more frequently. For example, small, cross-cutting groups met weekly to share the findings of their tests and pilots and to talk about where they might find resources (including those for a new analytics team) to fix the problems surfaced in those tests. These insights were shared directly with business-unit heads to help drive alignment at the executive level and to ensure that everyone was on the same page as to what the problems were and what solutions were working.

3. Deploying digital talent with agility

Talent was a bottleneck holding back the pursuit of digital initiative in the organizations we spoke with. Matters were made worse by the many different ways individual divisions deployed, prioritized, and ran the operating expenses associated with digital talent. While the marketing function, for example, might have completed its part of a project, the initiative would stall out if the operations function hadn’t prioritized launching the new initiative. Resources in one company were truly agile only within silos, not across the organization, and divisions reviewed talent allocation at wildly different intervals.

To get this right, the senior-leadership team formulated a consistent set of criteria for prioritizing the deployment of digital talent. As a group, it came to grips with resource trade-offs, such as productivity versus customer experience, and core versus new business. These criteria were reconsidered every quarter, and they changed as the company learned more about the efficacy of different elements of the digital strategy. The reallocation, however, was done weekly, in keeping with the urgency of digital initiatives and competitive threats.

4. Reallocating resources flexibly

Since these companies were on steep digital-learning curves, they regularly found

that they had overfunded certain projects and underinvested in others. Initiatives

that seemed most promising at the start of a quarter might seem less critical three

months later. Perhaps a company had learned that scaling the project would cost

far more than planned, or perhaps another project had come to show much greater

potential. Traditionally, one company had looked at reallocation once a year and given

great leeway to each division head. With these kinds of digital discoveries happening

often and everywhere, the annual process had to be drastically reconfigured.

First the top team shifted priorities for operating and capital expenditures, carving out a portion reserved for the execution of the digital strategy. Then they moved from an annual frequency to a quarterly one so that resources would always be focused where they would do the most for the enterprise as a whole. Not surprisingly, this was a difficult transition for many of the business-unit leaders, since they were accustomed to having their own budgets and calling the shots. While their input was still critical, they no longer had the final say: if a major cross-cutting initiative needed resources, they had to come from somewhere—and that might well force a business- unit leader to free up funds by placing a certain digital priority on the back burner. This piece was the most contentious, and there have been periods of backsliding, but the organization is moving steadily toward this new direction.

5. Shifting the culture

The frequent sharing of insights, successes, and failures buoyed the confidence of key leaders. And on the front lines, the freedom to make many small moves quickly diminished risks and started shifting the culture: managers and employees became less afraid of failure as they pursued digital initiatives. Considerations of M&A and capital expenditure, meantime, became more about business impact and well- understood risks (thanks to better data) and less about organizational politics. As leaders became clearer on how, exactly, their digital efforts were contributing to the twin goals of driving down costs and creating new and improved customer journeys, they grew more comfortable making bigger bets and swiftly reallocating human and financial capital.4 The full transformations are still under way because of the complexity of the organizational change, but the momentum is building with each success the companies achieve.

___________________________________

Aspiring to the speed and power of digital leaders may seem daunting. But increasing the rhythm of your business is an achievable goal; it just requires building out a set of clear, collaborative, and consistent practices for digital learning, engaging with data, sharing results, deploying talent, and reallocating resources. One of evolution’s lessons is that adaptable species outlive those that are merely more powerful. By accelerating the digital drumbeat, your company can transform itself from a powerful but slow target into a sleek and swift predator—the fastest fish that feasts on the slower ones that have failed to change.

————————————————————————————————

2 We have found, for example, that incumbents implementing artificial-intelligence initiatives move up the digital- learning curve at an accelerated rate, which helps them close the gap with first movers in their industry. See “Notes from the AI frontier: Modeling the impact of AI on the world economy,” McKinsey Global Institute, September 2018, McKinsey.com.

3 See Chris Bradley, Martin Hirt, and Sven Smit, “Strategy to beat the odds,” McKinsey Quarterly, February 2018, McKinsey.com.

Jacques Bughin is a director of the McKinsey Global Institute and a senior partner in McKinsey’s Brussels office, Tanguy Catlin is a senior partner in the Boston office, and Laura LaBerge is a senior expert in the Stamford office.

source: https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/McKinsey%20Digital/Our%20Insights/The%20drumbeat%20of%20digital%20How%20winning%20teams%20play/The-drumbeat-of-digital-How-winning-teams-play-final.ashx

Português

Português